- Chiliz price near breakout from a flag continuation pattern.

- CHZ bringing blockchain technology to the world of sports.

- Jump Trading equity investment will expand the fan token ecosystem globally.

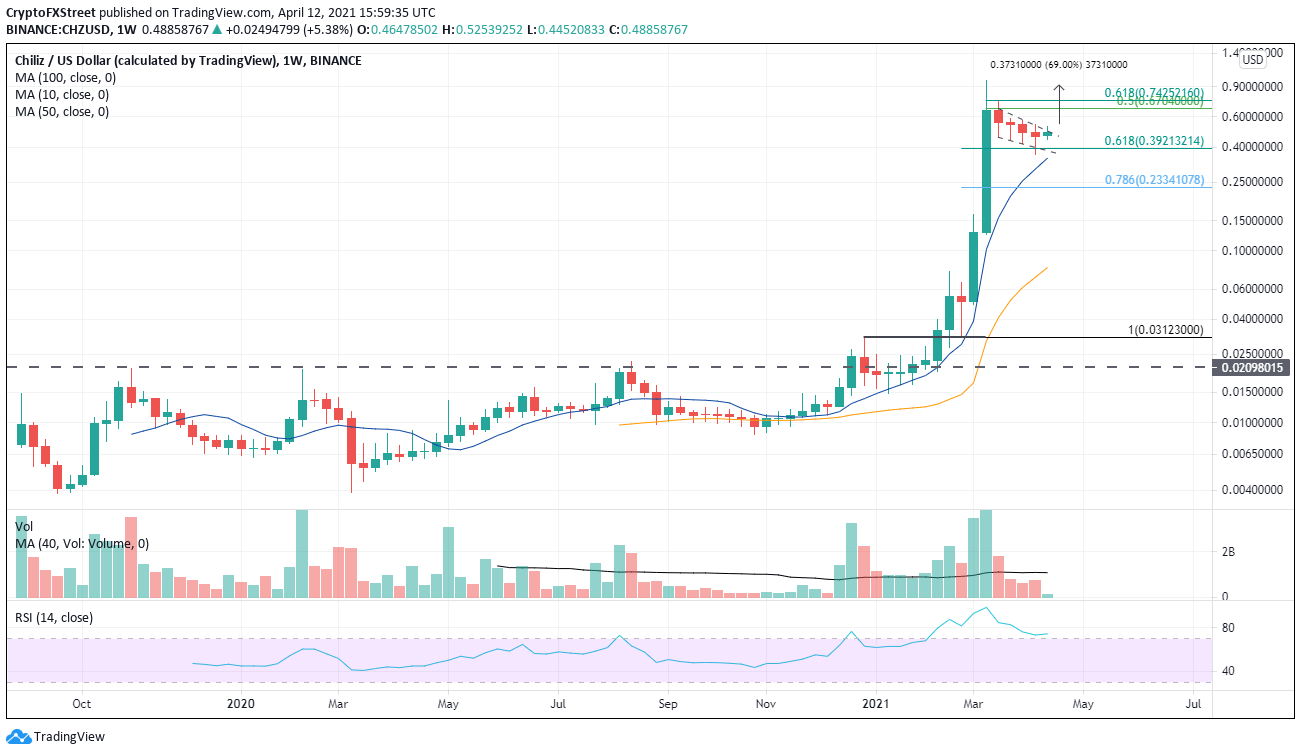

Chiliz price steadily declined in a flag pattern for weeks, but it closed last week with a hammer candlestick. The successful shakeout below the flag’s lower trend line combined with the test of the 61.8% retracement of the February-March rally has positioned CHZ in a timely position for purchase in the coming days.

Chiliz price action shows that bulls are now in control

A steep, sharp price trend precedes flag patterns, and in the case of CHZ, the February-March trend rallied over 3000%. Flags that are preceded by a rally of at least 90% have almost a zero failure rate and an average return of 69%. The best flags are less than 15 days, and volume declines throughout the pattern formation.

CHZ closes last week with a hammer candlestick that successfully tested the low of the flag and the 61.8% retracement level before engineering a rebound to close with a real candle body no larger than a third of the hammer pattern range.

The hammer pattern provides speculators with a clear trigger price at the hammer high of $0.541. The first area of resistance for the new rally is the 50% retracement of the March-April correction at $0.670, followed by the 61.8% Fibonacci retracement at $0.742.

A rally of 69% targets $0.914. If volume accompanies the rally, CHZ should not have any problem testing the March high at $0.976.

CHZ/USD weekly chart

A breakdown below the hammer will be met quickly with support at the 10-week simple moving average at $0.346. If selling accelerates, speculators need to mark the 78.6% retracement of the February-March rally at $0.233.