Idea of the Day

The swath of data from China released overnight had only minimal impact on FX markets for two reasons. Firstly, the key GDP release was broadly in line with expectations, rising 7.7% on the annual measure, vs. expectations for slowdown from 7.8% to 7.6%. Industrial production and retail sales data were also in line. Secondly, the impact on China on the rest of the world is also diminishing, on the basis of China moving away from an export led economy and one more built on domestic demand. China’s comparative cost advantage has also narrowed in recent years. As such, the Aussie barely flinched on the China news, confirming what we have been saying for well over a year now, namely that it is becoming less of a commodity and China story and more of a domestic one. On this basis, the currency is more in line with fundamentals at these lower levels, vs. the firmer one seen earlier in the year.

Data/Event Risks

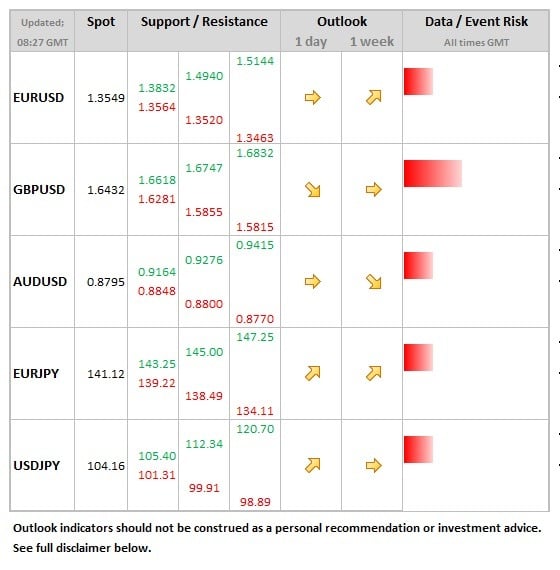

FX: No key data releases or events for the FX market at the start of the week. The main focus for the week is likely to be with the Bank of Japan meeting (result Wednesday) and minutes to UK MPC on the same day.

Latest FX News

GBP: More data showing rising houses prices overnight, with the Rightmove survey showing prices rising 6.3% on an annualised basis. Sterling rising modestly during the Asia session, cable settling just above the 1.64 handle.

EUR: Towards the end of last week, EURUSD found itself under pressure, but some recovery managed during the Asia session. Eurozone money market rates continue to be on the firm side, despite the passing of year end and this continues to offer support to the single currency.

GOLD: Talk of better demand from Asia helping to secure the better underlying tone, gold again reaching new highs for the year during Asia trade.

Further reading: