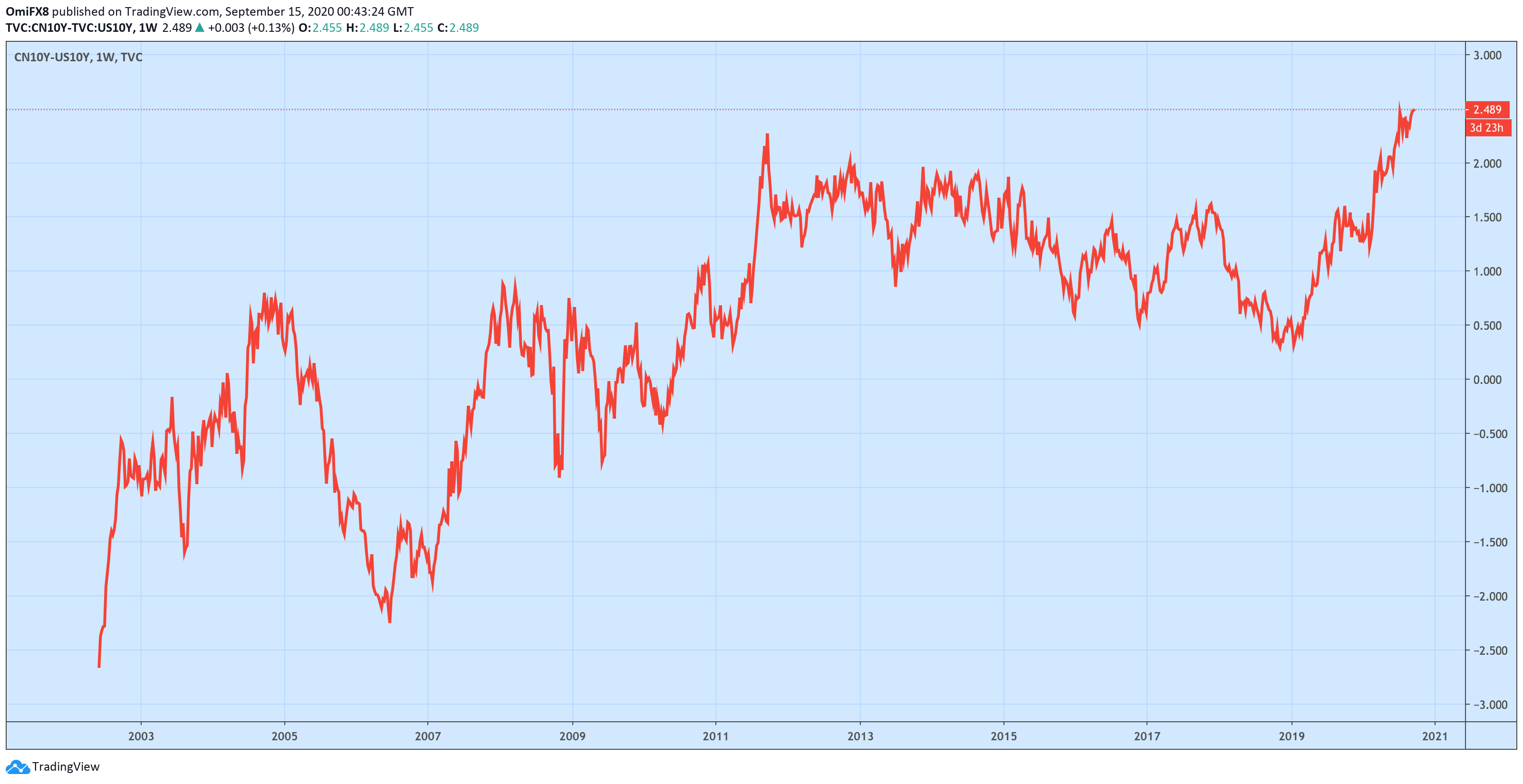

The spread between the Chinese and US 10-year government bond yield rose to 249 basis points on Monday. That’s the highest level since at least 2012.

The yield differential has nearly doubled since February and validates the Chinese yuan’s 3.5-month uptrend. The yuan is now trading at 6.80 per US dollar, representing a 5% decline from 7.17 per US dollar observed in May.

Goldman Sachs and few other investment banks expect the dollar sell-off to continue over the near term.

As for Tuesday, the yuan may face some selling pressure if the Chinese Retail Sales and Industrial Production data, scheduled for release at 02:00 GMT, prints below estimates.