Official Chinese figures are always treated with a significant amount of doubt by the markets. Nevertheless, the publication still has a strong impact.

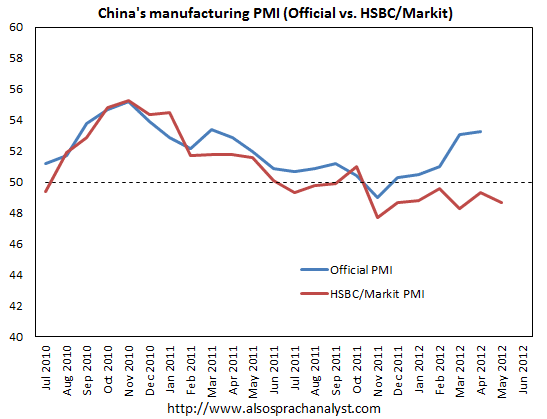

However, the recent divergence of the official manufacturing PMI and the unofficial HSBC/Markit PMI makes the grain of salt a bit bigger.

For the month of May, the unofficial figure showed deeper contraction, with a score of 48.7 points. This happens as the official PMI remains well above the 50 point mark.

This chart by Also Sprach Analyst shows it nicely:

Also electricity usage and comments from Australian companies trading with China lean towards the unofficial, more downbeat figures.

It seems that also Chinese policymakers don’t really believe their own figures: China recently lowered its interest rate for the first time since 2008.

The world is focused on Greece and Spain, yet the slowdown in China and in India probably has a more significant impact on the world.

Further reading: The ECB Pushed Spain to the Bottom – Will it Pull Spain Out Now?