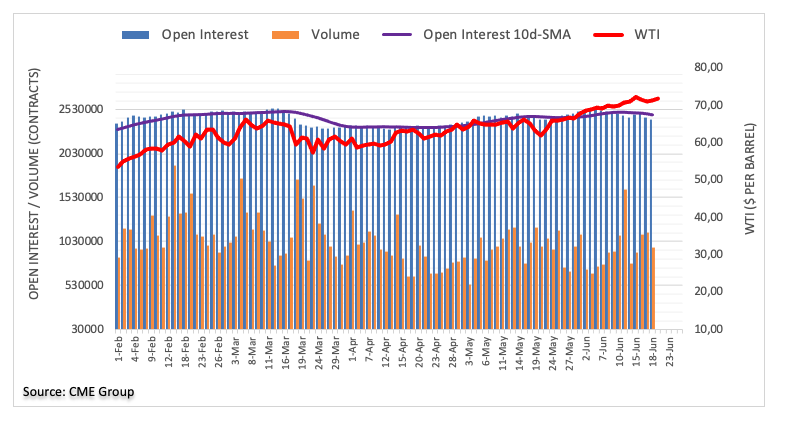

CME Group’s flash data for crude oil futures markets noted investors trimmed their open interest positions for the second session in a row on Friday, this time by around 27.1K contracts. Volume followed suit and shrank by 176.5K contracts after three daily builds in a row.

WTI still targets $73.00

Friday’s uptick in crude oil futures markets was amidst shrinking open interest and volume, noting some short covering behind the move. That said, a corrective decline remains well on the cards, although the broad positive stance in crude oil looks unchanged so far. That said, WTI faces the immediate target stays at the YTD highs near the $73.00 mark per barrel.