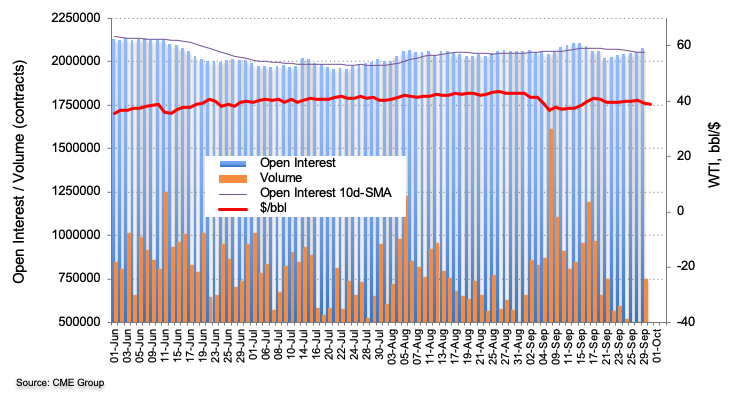

CME Group’s preliminary readings for crude oil futures markets showed investors increased their open interest positions for the sixth consecutive session on Tuesday, this time by around 20.5K contracts, recording at the same time fresh multi-week tops. In the same line, volume went up sharply by around 343.3K contracts, the largest single day build since September 8 and also coincident with another sell off in the commodity.

WTI: A retracement to the $36.00 region is not ruled out

Prices of the WTI sold off to the $38.40 region on Tuesday amidst rising open interest and volume. That said, further losses remain well on the cards for the West Texas Intermediate and could extend to the area of the September lows near the $36.00 mark per barrel.