- The re-election of President Maduro in Venezuela is seen as bullish for oil prices as the US are likely going to impose new sanctions on the country.

- Crude oil is also being boosted by US-China constructive trade talks.

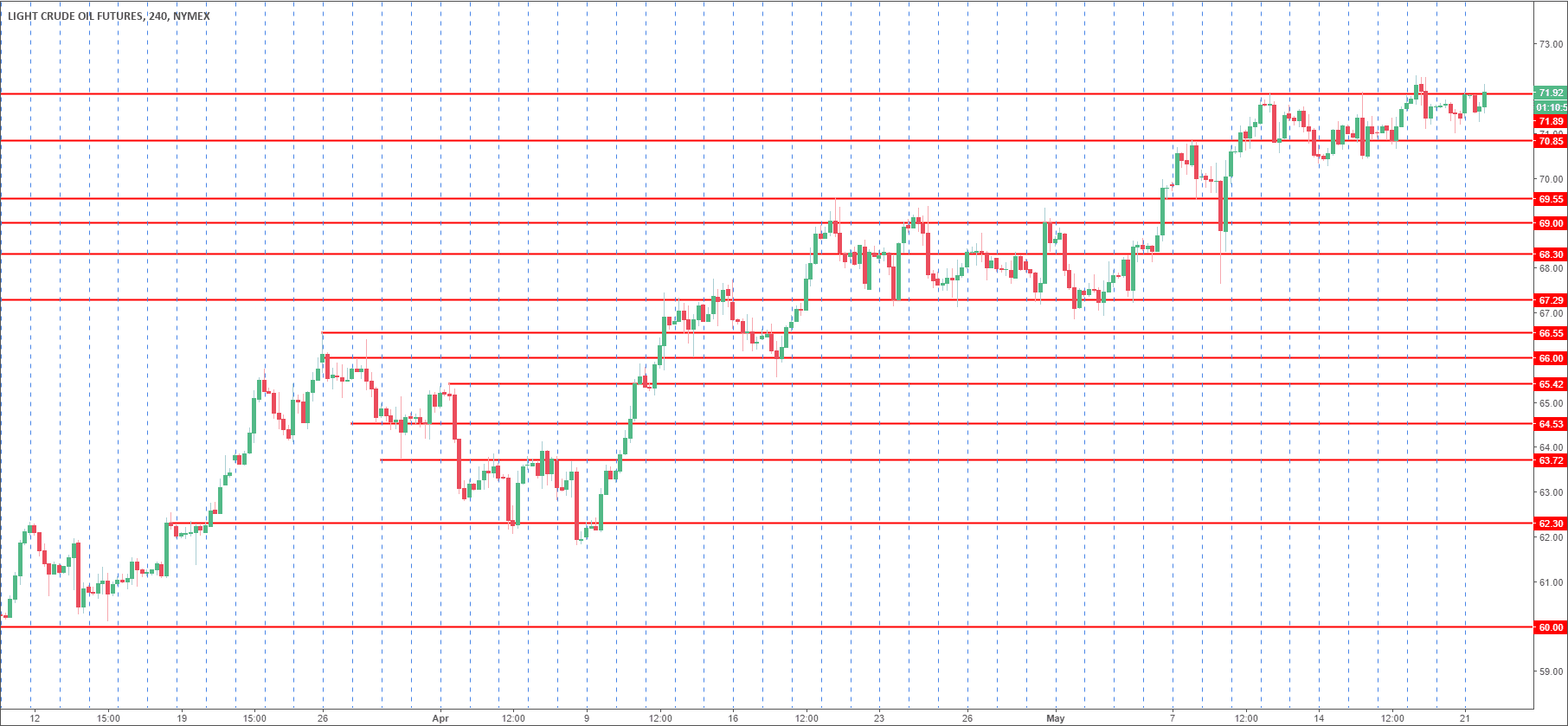

Crud oil West Texas Intermediate (WTI) benchmark is trading at around $71.94 a barrel up 0.40% on Monday’s trading.

Crude oil got a boost to 71.88 in Asia and then fell to 71.25 intraday low in the American forex session. Then crude jumped almost 90 cents from its intraday floor to reach 72.10 at the London close. The market is now consolidating in the 71.90 region.

The constructive talks between the US and China over the trade war have sparked risk-on sentiment on Monday. Crude oil was also benefitting from the easing of international trade tensions as it was supported throughout the day.

In Venezuela, the country is facing a deep crisis and analysts argue that after the re-election of President Maduro, the US will likely to impose some fresh sanctions on the country and likely target its oil industry. Venezuela oil production has fallen to a 70-year low. Meanwhile, Conoco seized key PDVSA assets in the Caribbean.

“The next step is sanctions against the oil sector,” says Diego Moya-Ocampos, a political analyst at IHS Markit. “This is crucial because Venezuela’s oil sector represents 25% of GDP (gross domestic product), 50% of fiscal revenues and 97% of revenue from foreign exchange”¦ So, obviously, sanctions on the oil sector in Venezuela will be a game changer,” the analyst added.

Oil prices are further supported by the OPEC and non-OPEC agreement to cut oil production and by the US withdrawing from the Iran nuclear deal which can put at risk up to 500,000 barrels a day according to analysts.

Crude oil WTI 4-hour chart

Slobodan Drvenica at Windsor Brokers wrote: “bulls eye fresh 3 ½ year high at $72.28 (posted on 17 May), break of which would expose Fibo projections at $72.48 & $72.85 (138.2% & 161.8% respectively), with stronger bullish acceleration expected to open $74.94 (Oct 2011 low) and $76.35 (Fibo 61.8% of 107.45/$26.04 fall) in extension. Top of thick rising 4-hr cloud ($71.08) and ascending 10SMA ($71.13) mark solid supports which should ideally contain dips and keep bulls intact. Res: 71.86; 72.28; 72.48; 72.85. Sup: 71.13; 70.65; 70.25; 70.00.”