- The oil market is concerned about rising oil output to be potentially announced at the next OPEC meeting on 22-23 June in Vienna.

- The EIA saw a draw of -5.914 million barrels against -1.898 million expected but traders sold crude oil in anticipation of a rising output announcement on June 22.

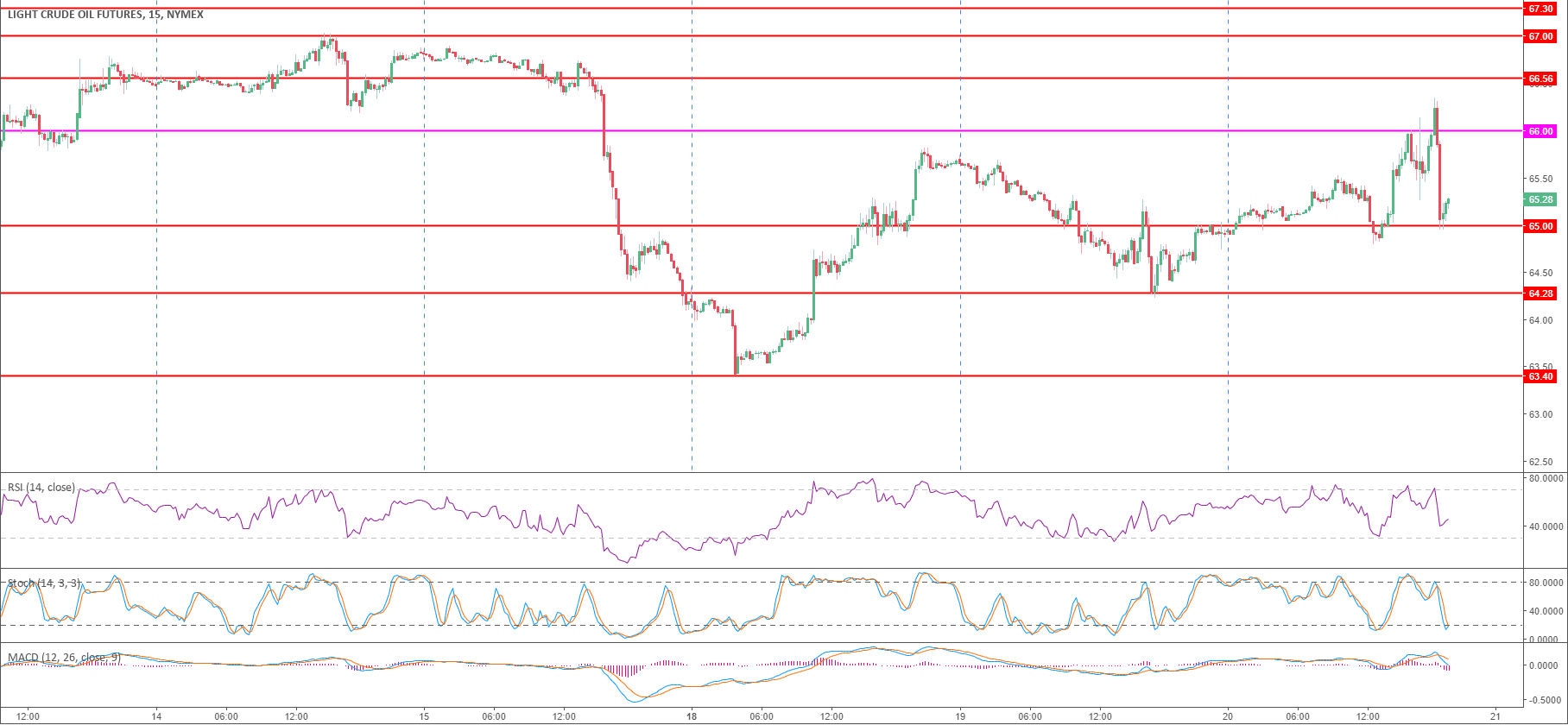

Crude oil is currently trading at around 65.43 after an attempt to break above the 66.00 level.

Earlier in the day, the Energy Information Administration crude oil stockpile came at -5.914M versus -1.898M expected by analysts. Although the draw was potentially bullish for oil, investors disregarded the data and dumped the black gold after a failed bull breakout above the 66.00 figure.

In fact, the market is focused on the next OPEC/non-OPEC (including Russia) meeting which will take place on 22 and 23 June in Vienna.

It has been reported that Saudi Arabia is trying to convince other members to raise oil output. Russia is also favorable to a rise in production while Iran is opposed to the move as it is concerned of a price drop.

“The run-up to this OPEC meeting is fraught with uncertainty with Iran from the onset adopting a very entrenched opposition to any supply increase,” said Harry Tchilinguirian, head of oil strategy at BNP Paribas.

Crude oi WTI 15-minute chart

Oil failed to break above the 66.00 level and bears are now potentially planning to break below the 65.00 figure.

Spot rate: 65.43

Relative change: -1.45%

High: 66.35

Low: 64.77

Trend: Bearish

Resistance 1: 66.00 figure

Resistance 2: 66.56 May 31 low

Resistance 3: 67.00 figure

Support 1: 65.00 figure

Support 2: 64.26 Tuesday’s low

Support 3: 63.40 current weekly low