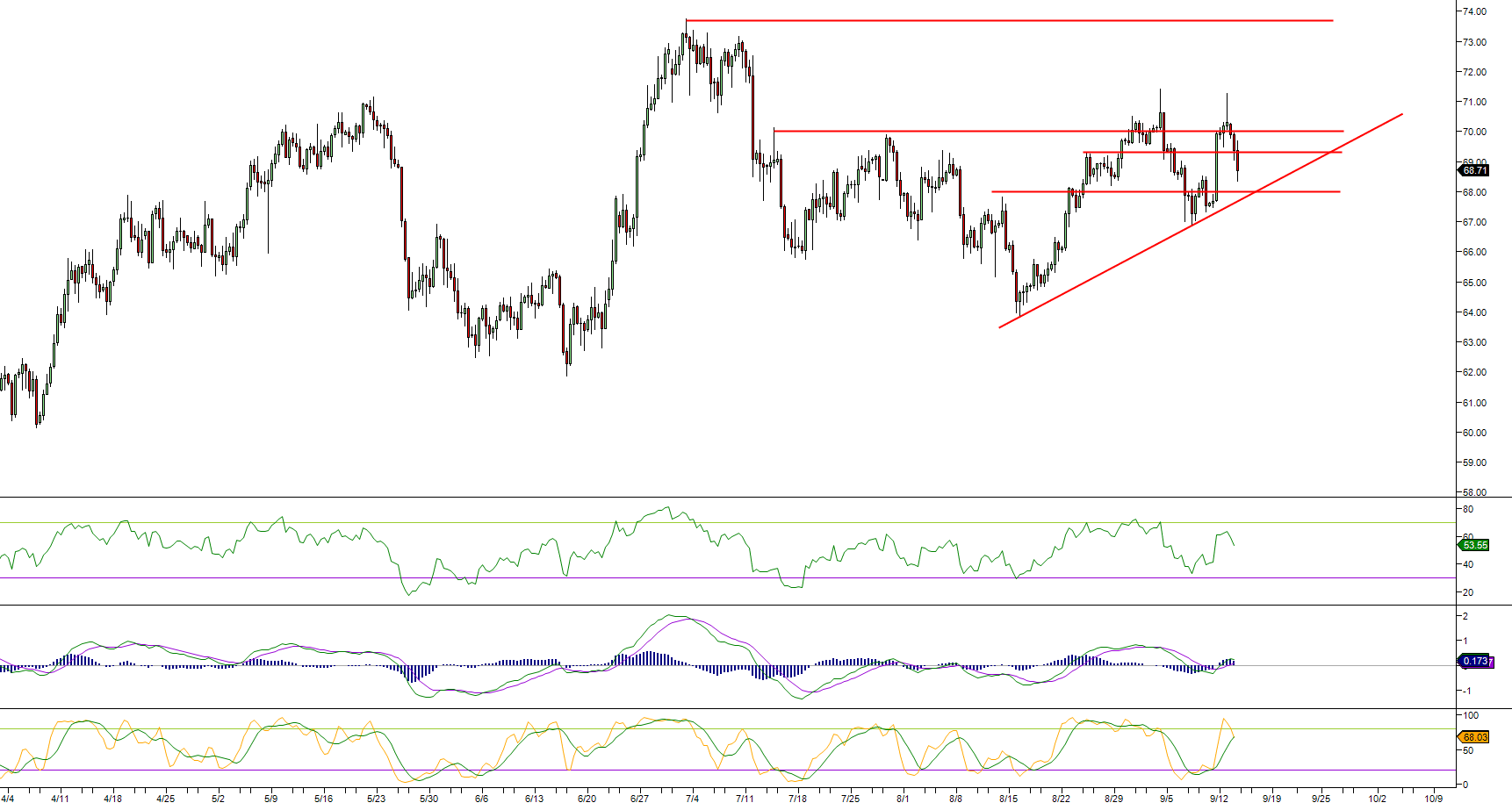

- Crude oil main bull trend is on hold as the market printed a double top.

- Bulls lost quite a lot of momentum as the RSI, MACD and Stochastics indicators are turning bearish. Bears objective is to target the consolidation area near $68.00 a barrel.

- A bull breakout above 69.30 would invalidate the bearish bias.

Crude oil WTI 480-minute chart

Spot rate: 69.69

Relative change: -2.14%

High: 70.25

Low: 68.33

Main Trend: Bullish

Short-term trend: Bearish

Resistance 1: 69.30 August 24 high

Resistance 2: 69.44 June 25 high

Resistance 3: 70.00 figure

Resistance 4: 70.53 May 24 low

Resistance 5: 71.41 September 4 high

Support 1: 69.00 figure.

Support 2: 68.00-68.30 zone, figure and supply/demand level

Support 3: 67.84 August 14 swing high

Support 4: 67.16 June 14 high

Support 5: 67.72 June 26 low

Support 6: 66.85 August 9 low