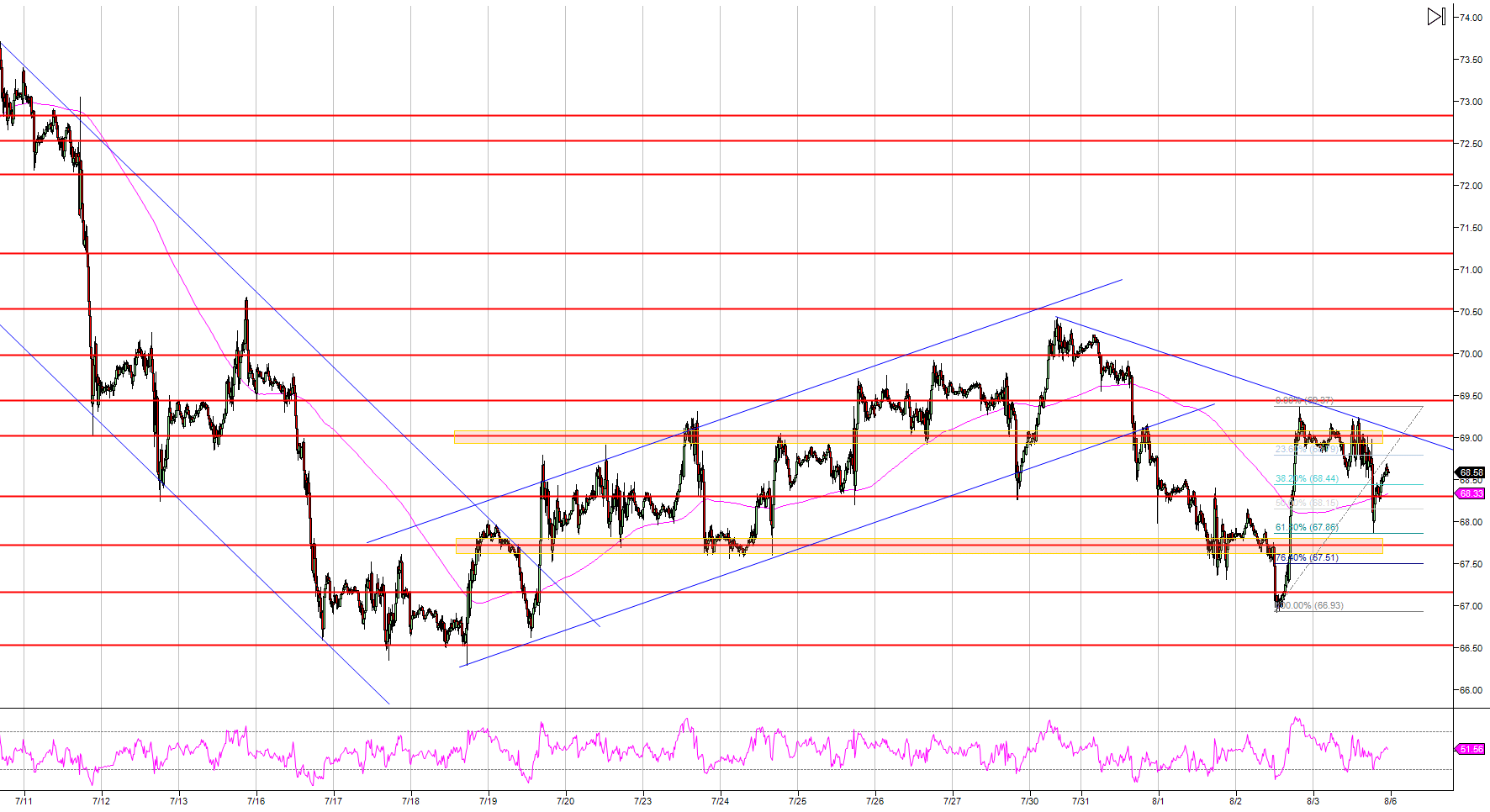

- Crude oil was unable to continue the bull rally initiated on Thursday as the market is having a 61.8% Fibonacci retracement from the last bull leg (August 2).

- Next week bulls will try to push the market above $69.00 a barrel while bears will try to drive the market below the 67.72 support.

- The market might need to consolidate some more below 69.00, however, the current bullish momentum favors a breakout above 69.00 as long as the market holds 67.72.

Spot rate: 68.56

Relative change: 0.52%

High: 69.21

Low: 67.90

Trend: Bullish

Resistance 1: 69.00 figure

Resistance 2: 69.44 June 25 high

Resistance 3: 70.00 figure

Resistance 4: 70.53 May 24 low

Resistance 5: 71.19 May 23 low

Resistance 6: 72.13 July 6 low

Resistance 7: 73.00 figure

Support 1: 68.30 supply/demand level

Support 2: 67.72 June 26 low

Support 3: 67.16 June 14 high

Support 4: 66.53 June 20 high

Support 5: 65.71, June 22 low

Support 6: 65.00 figure