Here’s what you need to know on

Markets:

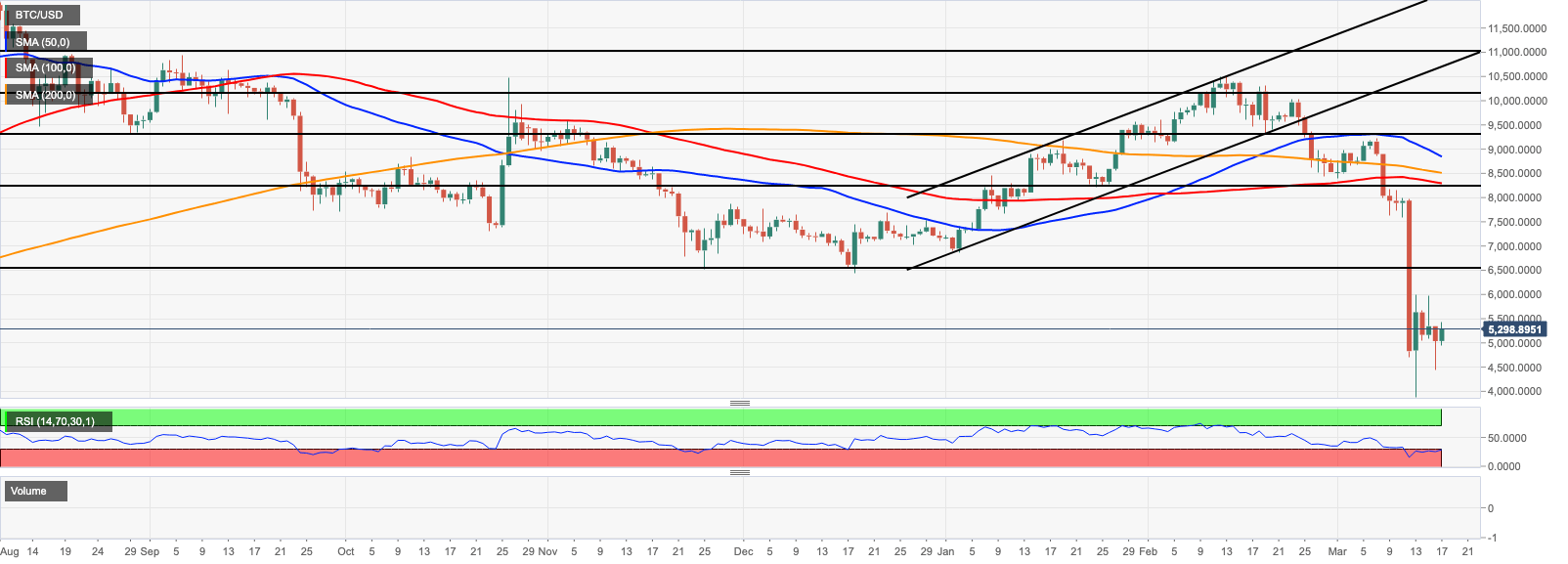

BTC/USD has recovered to $5,300, having gained nearly 5% since the start of the day. Despite the upside move, the first digital coin is moving within a short-term bearish trend amid low volatility.

ETH/USD regained ground above $110.00 and settled at $117.00 in Asia. The coin is up over 5% from the levels registered at the beginning of the day; however, the downside momentum is gaining traction again.

XRP/USD attempted to move above $0.1500 but returned to $0.1477 by press time. The coin is up 4.5% since the beginning of Tuesday.

Among the 100 most important cryptocurrencies, WAX (WAXP) $0.0376 (+36.3%),Synthetix Network Token (SNX) $0.4530 (+15.6%) and KuCoin Shares (KCS) $0.9480 (+10.05%) are in the green zone. The day’s losers are Komodo (KMD) $0.2886 (-8.0%),v.systems (VSYS) $0.0176 (-6.9%),Nexo (NEXO) $0.0845 (-6.4%).

Chart of the day:

BTC/USD, daily chart

Market

Tim Draper, a billionaire venture capitalist retains a positive view on Bitcoin. He believes that once the coronavirus scare is over, Bitcoin will shine again as it will be more efficient in dealing with a crisis that governmental measures. He also added that panic is more harmful to the economy than a virus.

The fear is far worse than the virus. The governments have it wrong. Stay open for business. If not, so many more people will die from a crashing economy than from this virus

Earlier, Tim Draper forecasted that Bitcoin would rise to $230,000 by 2023.

Industry

A regulated cryptocurrency trading platform Bakkt closed Series B financing round where it raised $300 million. Bakkt, which is a part of Intercontinental Exchange (ICE) offers institutional traders deliverable Bitcoin futures.

Bakkt Completes $300 Million Series B Financing. Investors include Intercontinental Exchange, Microsoft’s M12, PayU, Boston Consulting Group, Goldfinch Partners, CMT Digital, and Pantera Capital.

Also, the company plans to launch an app in summer that will allow users to tap a broad market of digital assets worth nearly $1 trillion. Notably, Bakkt takes a broad view of digital assets that include things like “loyalty and rewards points, in-game assets, merchant stored value, and cryptocurrencies.”

Shell Sonnen Group announced a partnership with Energy Web Foundation (EWF) that will be focused on building a virtual electric power plant (VPP) in Germany based on blockchain technology. The storage systems for excess energy will be bound into a distributed network to reduce the consumption of renewable energy in Germany. Jean-Baptiste Cornefert, Managing Director of sonnen eServices, commented:

With a flexibility market for renewable energies and the automatic exchange of supply and demand, we are realizing the next step towards a smart grid that can deal much more flexibly with fluctuations from renewable energy. Virtual power plants such as those from sonnen are the technical building block for this power grid that has been missing up to now and can help to ensure that less green energy is lost.

Regulation

The central bank of Russia clarified its position on cryptocurrencies and it has barely changed. The cryptocurrencies shall never become legalized in Russia as they pose risks to financial stability and create opportunities for money-laundering and financing illegal activities. However, according to Alexey Guznov, the head of the legal department in the Bank of Russia, the regulator cannot ban people from buying and holding Bitcoin, provided that they purchase it and perform transactions in a jurisdiction where it is allowed.

The Reserve Bank of Zimbabwe plans to develop a legal framework for cryptocurrencies. The regulator has already started creating a policy framework for fintech companies that will help to protect users. RBZ deputy director financial markets and national payment systems, Mr Josephat Mutepfa, commented:

We have already started to come up with a fintech framework because in regulation everything should be well structured. The framework, which is a regulatory sandbox, will be assessing the crypto-currency companies as to how they are going to operate. Once you enter the sandbox you either exist as a bonafide product to enter the market or you are guided to say that you need to partner a bank, a mobile money platform or your product needs to be licensed like a microfinance company.

Quote of the day

I actually never seriously thought that we could see hyperinflation in the US and Europe. After these last 2 weeks I’ve changed my mind on this. What’s interesting is when you saw this happen in countries like Venezuela they fled to USD. Where will people with USD flee to?

Whale Panda