- Hitbtc denies access to its services for Japanese residents.

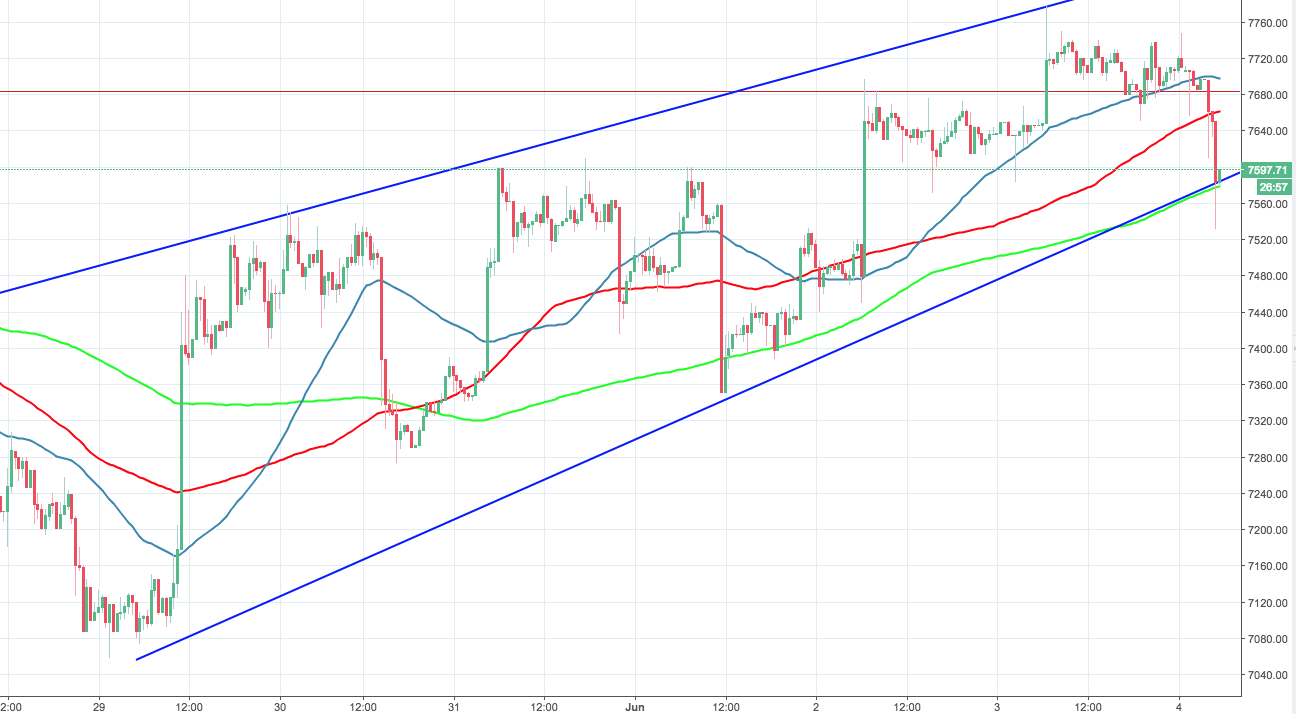

- All coins are sliding down, Bitcoin is close to critical support.

Cryptocurrency market switched back in red mode after a period of recovery during the previous week. Bitcoin is losing 2% since the start of the day, Ethereum and Ripple are down 2.5% and 4.5% respectively. IOTA and Bitcoin Gold are among the biggest losers of cryptocurrency Top-10.

Hitbtc, the Hong Kong exchange for trading digital assets with average daily volume over $278M has stopped servicing clients in Japan to avoid troubles with Japanese Financial Services Agency. The operator updated its Legal section of the website to include the information about service restrictions.

“For the avoidance of any doubt and in accordance with the Japan Payment Services Act, HitBTC has temporarily suspended providing virtual (crypto) currency exchange services to residents of Japan. In case our technology detects that you use our Services from an IP address registered in Japan, or any other services registered in Japan, you would be asked to confirm that you are not a resident of Japan by providing information on your residency within KYC procedure.”

BTC/USD dropped to intraday low at $7,531 before recovering to $7,600 handle. The digital currency No.1 has returned above the upside trendline at $7,570 and above 200-SMA (30-min chart), though the coin is vulnerable to a new sell-off wave as long as it stays below $7,660 (100-SMA) and %7,700, strengthened by 50-SMA.