Here’s what you need to know on Wednesday

Markets:

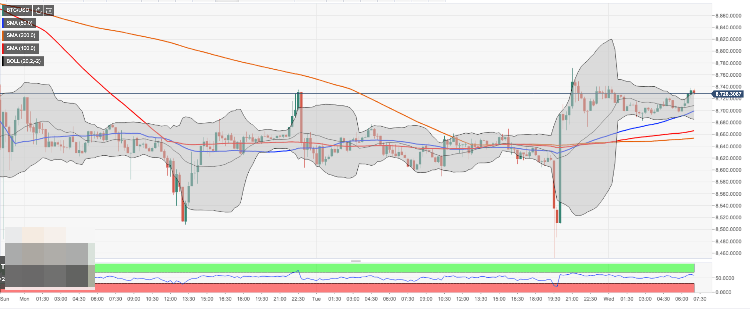

BTC/USD is currently trading at $8,734 (+0.8% on a day-to-day basis). The coin has barely changed since the beginning of the day. The short-term trend is bearish.

The ETH/USD pair is currently trading at $169.6 (+1.0% on a day-to-day basis). The Ethereum’s recovery is capped by a psychological $170.00; now the coin is moving within a short-term bearish trend amid low volatility.

XRP/USD settled at $0.2379 after a spike to $0.2255 on Tuesday. The coin is down 0.47% in recent 24 hours.

Among the 100 most important cryptocurrencies, the best of the day are Komodo (KMD) $0.7805 (+27.5%), Golem (GNT) $0.0407 (+23.7%) and SOLVE (SOLVE) $0.1145 (+8.3%), The day’s losers are, Centrality (CENNZ) $0.0620 (-8.5%), MCO (MCO) $4.76 (-5.6%) and Bytecoin (BCN) $0.0002 (-5.32%).

Chart of the day:

BTC/USD, 15-min chart

Market:

Bitcoin SV has settled above $300 amid strong bullish sentiments. Experts believe that this thome the upside momentum is driven by the upcoming hard fork of Bitcoin’s offshoot. The update known as Genesis will take place on February 4. It is expected to reverse some of the changes implemented on Bitcoin protocol, to rake it back to Satoshi’s vision. The analysts point out to a high probability of massive sell-off following the event within “buy the rumor, sell the fact pattern”.

Industry:

Litecoin network processed transactions worth over $100 billion, according to the data, provided by Bitinfocharts. While this is a solid figure that proves a sustained usage of the network, it is still well below the figures registered in 2018. However, the experts of Litecoin.com noted that the data may be skewed due to high trading volumes in January 2018, when $5 billion a day was transacted on the peak of the massive bull market.

The digital currency branch of Jack Dorsey’s payments company Square has announced the development of the Lightning Development Kit. The new feature will help Bitcoin wallet developers integrate the micropayments service with their existing products.

We’ve got the team. We’ve got the mission. We’ve got hit or miss tweets. And now it’s time to talk about what we’re building: Introducing the Lightning Development Kit, or LDK.

Regulation:

A group of global central banks joins forces to assess potential use cases for central bank-issued digital currencies (CBDC) and share their experience in dealing with this type of asset in their respective jurisdictions. According to the announcement published on the website of the Bank of England, the central banks of England, Japan, the Eurozone, Canada. Sweden and Switzerland together with the Bank will International Settlements look into CBDC use cases in such areas as “economic, functional and technical design choices, including cross-border interoperability; and the sharing of knowledge on emerging technologies”.

Based in the Netherlands cryptocurrency exchange XRParrot halted operations due to new anti-money laundering regulations adopted by the European countries. The exchange was based on XRP and served as a payment gateway for Ripple’s coin.

XRPCommunity: it’s been great. However, due to new regulations in The Netherlands (The home of XRParrot) the XRParrot service comes to an end. Accidental or automatic transfers to XRParrot will still be processed for some time (users will be informed). Thank you for everything!