Here’s what you need to know on Tuesday

Markets:

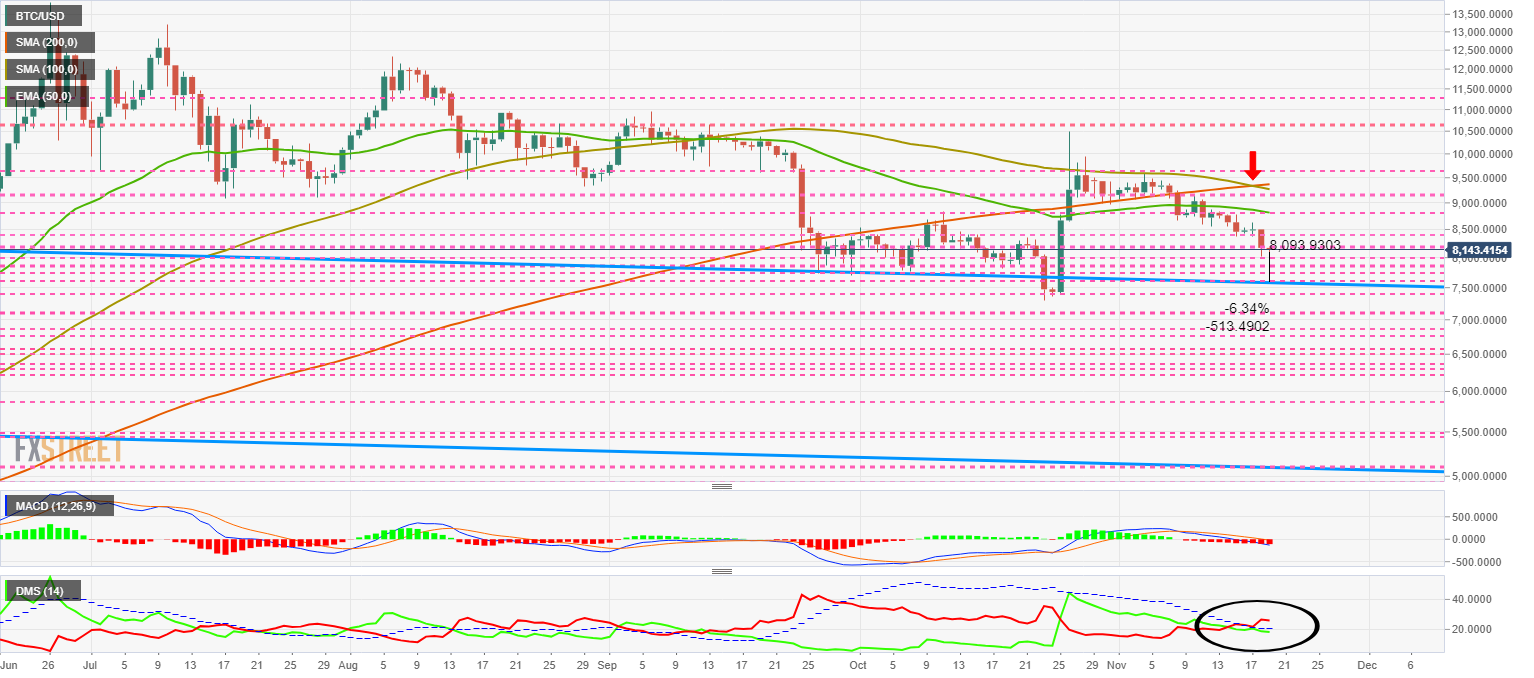

– BTC/USD falls 3.65%, recovering from session lows of $8,081. The remaining margin falls above 6% to the key target of $7,569.

– ETH/USD down 3.58% in the session, continues to do better than Bitcoin even when strong sellers appear. The session low is at $175.5.

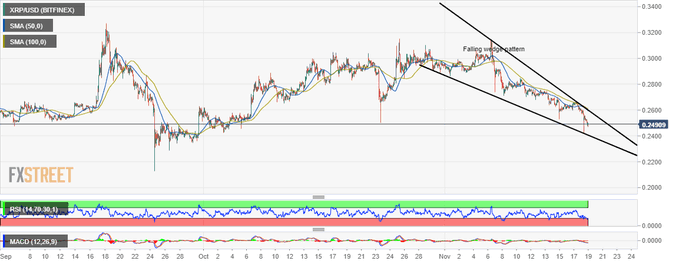

– XRP/USD is the worst of the Top 3 and drops more than 4.30%, losing the $0.25 level. The session minimum is $0.246.

– The day’s winners are KAVA (+6.8%), MFT (+6.60%) and THETA (+2.34%). Red is led by BEAM (-13.75%), TOMO (-10.99%) and RLC (-10.5%).

Chart of the day:

BTC/USD

Regulation:

The United States Securities and Exchange Commission (SEC) notified on October 15 a new review process of the ETF proposed by Bitwise. The SEC rejected the first Bitwise proposal last October.

Kenneth Blanco, Director of the US Financial Crimes Enforcement Network, has made public new measures to prosecute and sanction money laundering practices in the crypto industry. Cryptocurrencies firms must identify all parties involved in capital movements over $3,000.

Industry:

VISA, the payment management company, is working on Blockchain technology. The main goal is to adapt to the requirements of regulators on security, privacy and fidelity in the massive management of data.

Hahn Air, a German company, dedicated to charter flights, uses blockchain technology for the issuance of tickets and registrations. The company also accepts payments in Ethereum and LIF.

Local Ethereum, the peer-to-peer trading platform, changes its name to LocalCryptos and starts taking transactions in cryptocurrencies other than Ethereum.

Tassat, a New York-based Fintech, in collaboration with market maker digital Blockfills, will launch an institutional trading platform for Bitcoins in US dollars. The novelty is that the exchange price will be fixed beforehand in short auctions.

Quote of the day:

Forex Crunch: @forexcrunch

Ripple price analysis: XRP/USD nurtures breakdown towards $0.24.