Here’s what you need to know on Tuesday

Markets:

- The BTC/USD pair is currently trading at $6,880 (-2% on a day-to-day basis). The coin broke below critical $7,000 but found support on approach to $6,800 handle.

- The ETH/USD pair is currently trading at $131.50 (-6% on a day-to-day basis). The Ethereum is moving within a downside trend in sync with the market with the support located at a psychological $130.00.

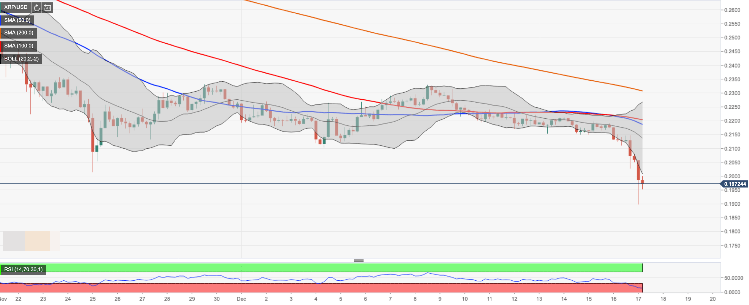

- XRP/USD is currently trading at $0.1970 (-6.9% on a day-to-day basis). The XRP touched the area below $0.19 on Monday amid growing bearish pressure. The coin remains one the worst-performing altcoins out of top-20 on a day-to-day basis.

- Among the 100 most important cryptocurrencies, the best of the day are Waves (Waves) $0.8491 (+24.7%), Fetch.ai (FET) $0.0523 (+12.7%) and MINDOL (MIN) $4.53 (+12%). The day’s losers are Aurora (AOA) $0.00049 (-28.7%), EDUCare (EKT) $0.0669 (-18.50%), Decred (DCR) $17.9 (-12.9%).

Chart of the day:

XRP/USD

Market:

- A cryptocurrency exchange ErisX announced the launch of Bitcoin futures. The trading starts today, on Tuesday, December 17. The team promises to provide the highest level of service in line with the best industry practices. Notably, at the end of 2018, a large US-based broker TD Ameritrade Holding Corp invested in the platform intending to launch physical futures for Bitcoin Cash, Ethereum и Litecoin.

- The head of an investment company Pulte Capital Partner, Bill Pulte, bought 11 Bitcoins for $78,000. He is just another billionaire from the world of traditional finance that has discovered digital assets. Bill Pulte, a grandson of the founder of developers empire PulteGroup, believes that the ability to send money around the globe with no intermediary is the best feature offered by Bitcoin.

Industry:

- ETC Labs Core has rebranded to ETC Core to differentiate itself from ETC Labs. Also, ETC Core technology coordinator Stevan Lohja confirmed that the project was moving steadily towards essential Agarata hard fork that will allow for ETH compatibility.

- The largest Japanese cryptocurrency exchange Coincheck announced the end of margin trading. The leveraged instruments won’t be available for the customers of the exchange as of March 2020. All marginal positions are to be closed until March 13, 2020. Then the users will have time to transfer the balances from marginal accounts to their primary accounts until the end of the month.

- Coinbase, the largest cryptocurrency in the US, has become the largest validator of Texas, overtaking Polychain Labs. Binance takes fourth place. Notably, the Malta-based exchange added Tezos staking support only on December 4.

Regulation:

- Global banking regulator Basel Committee on Banking Supervision (BCBS) says that the cryptocurrency industry requires a conservative prudential treatment framework as an “immature asset class given the lack of standardization and constant evolution.”

- The Reserve Bank of South Africa (SARB) is set to tighten its cryptocurrency regulations to prevent citizens from using digital currencies for evading currency controls.

- CFTC Chairman Heath Tarbert believes that the US should become the world’s leader in the cryptocurrency regulation. Speaking at Harvard Kennedy School this week, he explained that the regulator focuses on anti-money laundering and counterterrorism financing aspects of cryptocurrency regulation.

Quote of the day:

%20Credible%20Crypto-637121634032252640.png)