- Cryptocurrencies have corrected lower after a sharp rally.

- Each digital coin faces critical resistance lines it must recapture to resume the rally.

- Here are the next levels to watch according to the Confluence Detector.

Cryptocurrencies have finally corrected some of their massive gains – a natural phenomenon in all financial markets. The rally has been partially inspired by Facebook’s entry into the blockchain world with its Libra project. Interest in Bitcoin and also other digital coins has soared and prices followed upwards as well.

Nevertheless, some have likely wanted to take some profits off the table after the massive jumps. BTC has nearly reached $14,000 and the correction proved almost as sharp as the rally – a dip below $12,000.

Crypto prices are making attempts to stabilize with the granddaddy of coins already back over $12,000.

What’s next? To end the correction, currencies face technical hurdles they must surpass to resume the bullish rally.

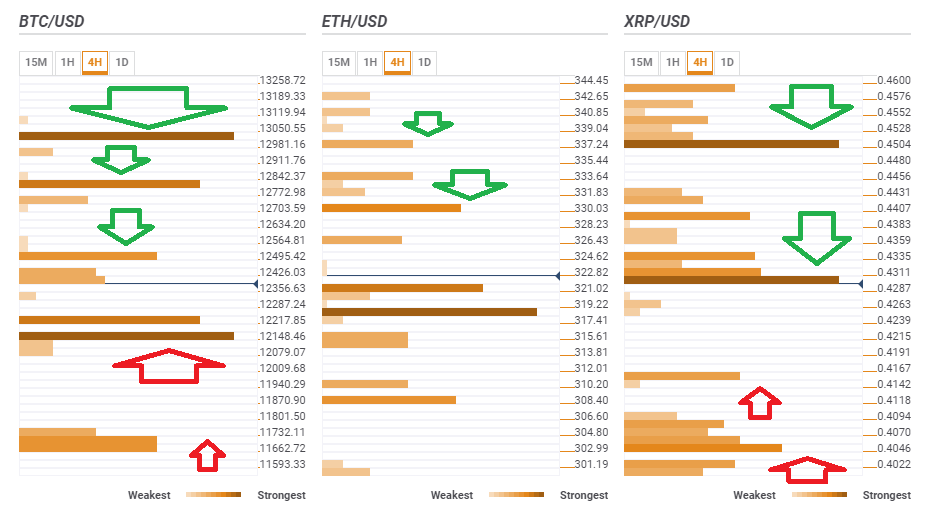

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD must break above $13,010

Bitcoin faces weak resistance at $12,500 where the Fibonacci 61.8% one-day converges with the previous 15min-high.

The next hurdle is at $12,805 where we find the Simple Moving Average and the previous 1h-high.

The most substantial resistance confluence is at $13,010 which is where the SMA 5-4h meets the Fibonacci 38.2% one-day line.

BTC/USD enjoys support between $12,148 and $12,227. This is a dense cluster including the Bollinger Band 1d-Upper, the SMA 200-15m, the SMA 50-1h, and the Pivot Point one-week Resistance 3.

Further support awaits at $11,700 where the Pivot Point one-day S1 and the previous daily low converge.

ETH/USD faces $330 as the first hurdle

Ethereum is better positioned to recover. Vitalik Buterin’s creation faces weaker resistance than Bitcoin’s. $330 is the confluence of the BB 1d-Upper, the SMA 10-4h, and the BB 15min-Middle.

At $337 we note the SMA 100-15m – only weak resistance.

ETH/USD has support at $321 which is the convergence of the BB 15min-Lower, the BB 1h-Lower, and the PP 1w-R2.

Close by, $318 provides further support with the juncture of the PP 1m-R1 and the SMA 100-1h.

XRP/USD needs to cross two lines

Ripple faces a duo of caps. It is battling $0.4300 which is a minefield including the Fibonacci 61.8% one-week and the BB 1d-Middle.

Further above, $0.4500 is the convergence of the Fibonacci 23.6% one-day and the Fibonacci 23.6% one-week.

Some support awaits at $0.4150 where the PP 1w-S1 awaits XRP/USD.

The last significant support cluster is at $0.4046 which is the confluence of the Fibonacci 38.2% one-month and the PP 1d-S2.