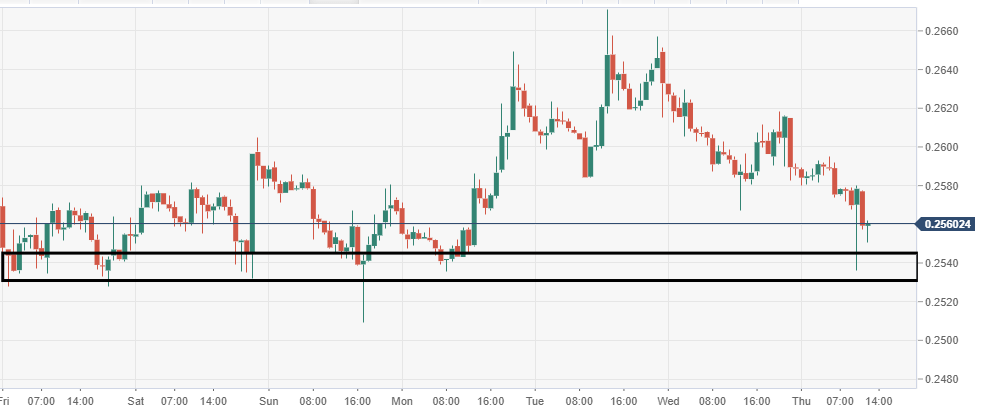

BTC/USD technical analysis: OBV indicator shows uptrend volume is wearing thin

BTC/USD is trading 0.32% lower today after the price/volume looks like its struggling to push the BTC/USD price higher.

On the 30-minute chart above as the price makes higher highs and then consolidates between 10,400-800 and you can see the On Balance Volume (OBV) indicator move lower.

The OBV indicator is a great tool for measuring the momentum for a move. Traditionally of the indicator keeps moving higher as the uptrend develops you can see the market get behind the move and the trend will continue to rally.

There are obviously exceptions to the rule when all of a sudden big buying volume comes in but more often than not it does work.

Ethereum market update: ETH/USD breaks trendline support in fresh declines

The narrative, “Ethereum (ETH) has bottomed but will soon recover” is a whole lot more complicated. At press time, ETH is valued at $172.72 after a breakdown at $175. The one-hour chart shows that the bears and bulls are engaged in a head-on war, expecting more downside movement.

On Wednesday, the legendary venture capitalist Fred Wilson came out with his latest blog on cryptocurrency market named “Some Thoughts On Crypto,” but had to revise his earlier bullish opinion on Ethereum. Back in 2017, Wilson had suggested that the market capitalization of ETH will bypass the market capitalization for Bitcoin (BTC) and eventually be worth more per coin. The downtrend experienced by ETH in the past two years coupled with challenges facing the network has warranted a revision of his earlier opinions.

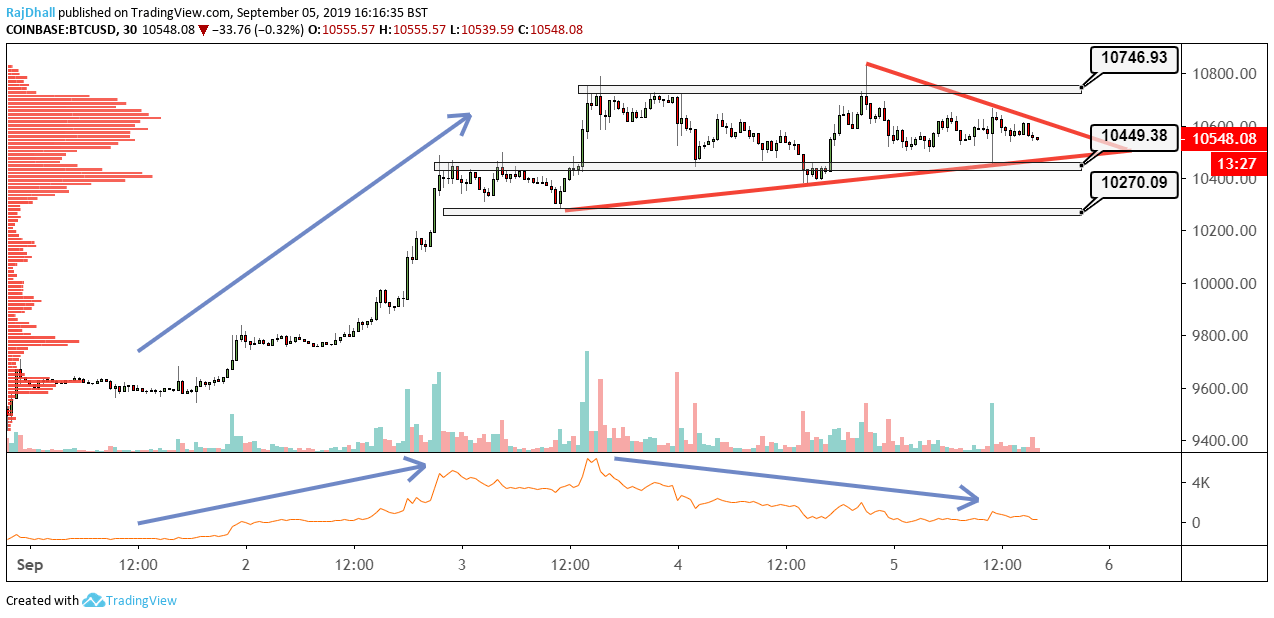

Ripple’s XRP technical analysis: XRP/USD breakout is imminent

Ripple’s XRP price on Thursday is trading in the red, down some 0.40%. XRP/USD price action continues to narrow, remaining in consolidation mode, moving within a bearish pennant structure.

Buyers are heavily trying the defend the $0.2500 mark, failure to do so could open the door to a strong wave of selling pressure. Should the bears force a breach the narrowing conditions, then the next major demand zone is seen down at $0.2000.

-637032901012414591-637033107732681852.png)