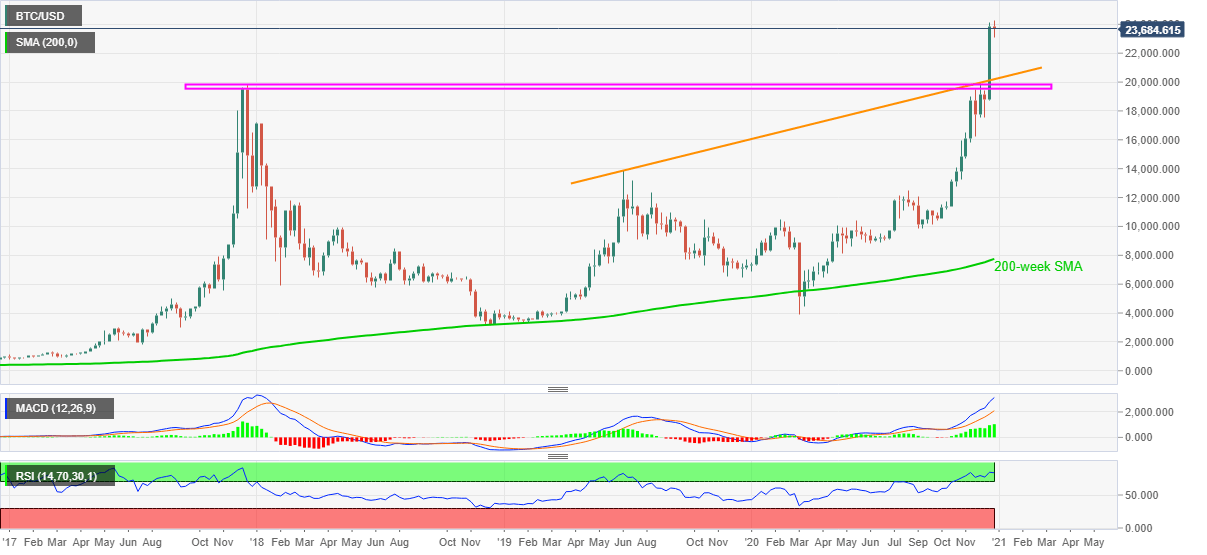

Bitcoin Price Analysis: BTC bulls have reasons to keep 24,000 on radar

BTC/USD prints 1.0% intraday gains while flashing 23,695 as a quote during early Monday. In doing so, the crypto major reverses the pullback moves from the latest record high of 24,300 while bouncing off 23,110 off-late.

Although overbought RSI conditions warn bulls, a sustained upside break of the 2017 peak, as well as an upward sloping trend line from June 2019, keeps the pair buyers hopeful.

As a result, BTC/USD bulls might not hesitate to eye the 30,000 psychological magnet as an immediate target ahead of moving on to the more strong fundamental hints of the 100,000 landmark.

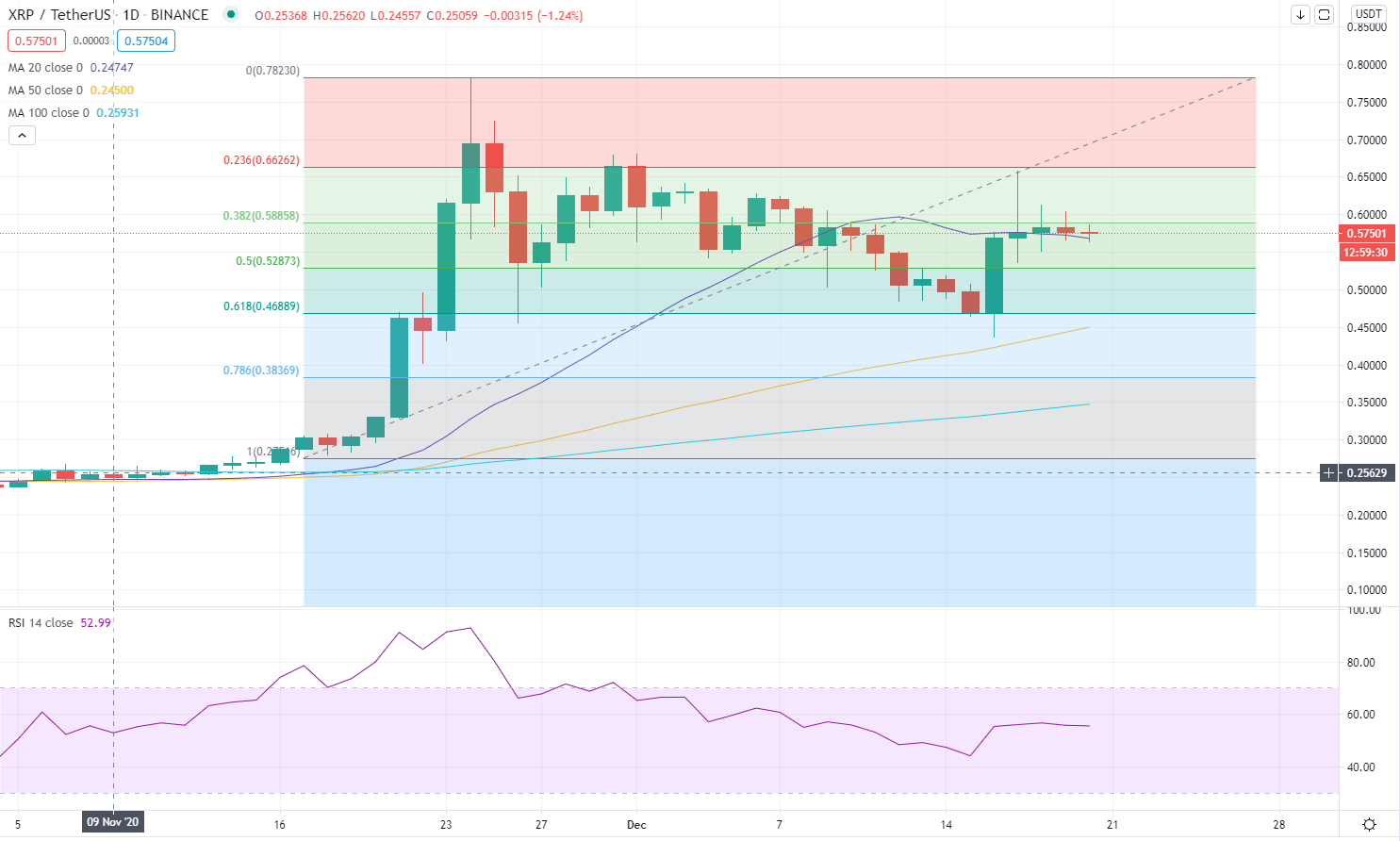

Ripple Price Prediction: XRP to target $0.66 with a daily close above $0.59

After closing the first two days of the week in the negative territory, Ripple rose sharply and touched its highest level in three weeks at $0.6585 on Thursday. However, XRP struggled to preserve its bullish momentum and went into a consolidation phase over the weekend. As of writing, Ripple was virtually unchanged on the day at $0.5760 and was gaining more than 12% on the week.

The Fibonacci 23.6% retracement of the bull run that saw Ripple price jump from $0.28 to $0.78 in a week in mid-November is currently located at $0.59. Although XRP rose above that level on Friday and Saturday, it failed to make a daily close there. If Ripple manages to flip that resistance into support, it could target the Next Fibonacci retracement, 23.6%, at $0.66.

Ethereum Price Prediction: ETH aims for $800 while FOMO kicks in

While Ethereum price has been appreciating against the dollar, no significant growth has been made when measured against Bitcoin because the flagship cryptocurrency has stolen the spotlight over the past few weeks.

Ethereum price stalls in gaining ground against Bitcoin

Ethereum has been performing well against the dollar, but when considering its price action against Bitcoin, the token of the smart contracts has remained stagnant.

Skew, a cryptocurrency data analytics provider, reveals that the ETH/BTC trading pair has been steadily declining since September 20. Since then, Ethereum price dropped below 3% as a percentage of Bitcoin price.