- Bitcoin is trading at $3,536 following a slight upside correction.

- XRP must correct above $0.34 in order to open the door for a further correction towards $0.4.

The weekend trading in the cryptocurrency market was literally uneventful. However, towards the end of the session on Sunday, the market dumped more than $5 billion. This selloff comes after three days of calmness. The market capitalization thinned from $122 billion recorded on Saturday to slightly below $117. There has been a marginal recovery today as bulls come back to reverse the trend.

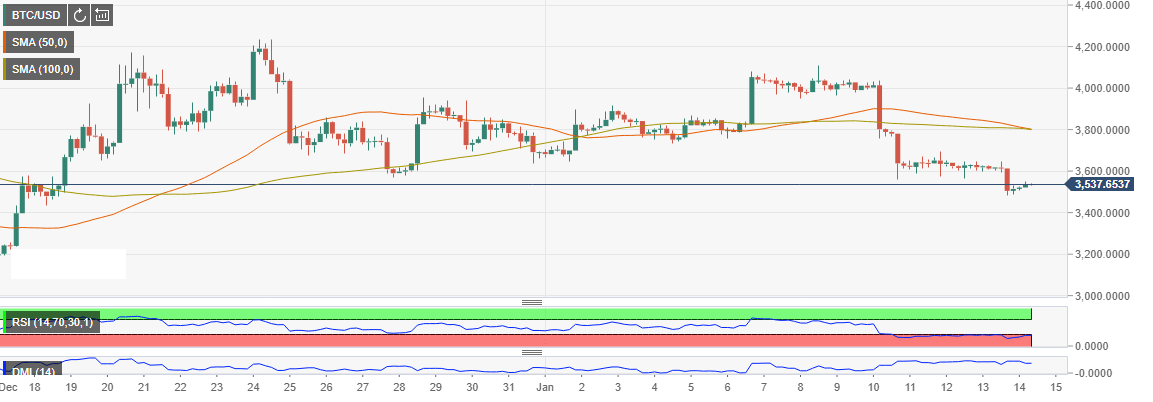

Bitcoin price technical picture

Bitcoin price made a lower correction after being rejected at $4,000 last week. There was a waterfall drop below the 50-day and the 100-day Simple Moving Averages (SMA) in the 4-hour timeline. The declines failed to find support at $3,800 and Bitcoin price slumped below $3,600. The drop on Sunday sent the asset further below $3,500 where BTC/USD formed lows around $3,480.14.

At present, Bitcoin is trading at $3,536 following a slight upside correction on Monday. However, it is unlikely that the bullish trend will break above the initial resistance at $3,600 today. The Relative Strength Index (RSI) in the same range is still in the oversold while the Directional Movement Index is horizontal at 49.7 to show that the current trend will continue in the near-term.

BTC/USD 4-hour chart

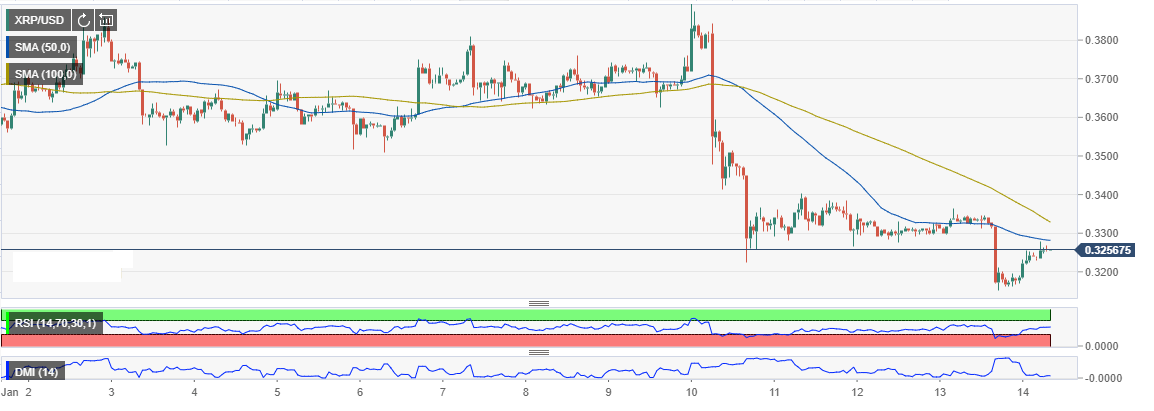

XRP price technical picture

Like Bitcoin, XRP also contributed to the drop in the market on Sunday. The asset corrected lower after failing to make it above the resistance at $0.34. The initial support at $0.33 gave in to the selling pressure as XRP headed south forming a low at $0.315. There has been an upward correction above $0.32 although the 50-day SMA is limiting gains on the hourly timeframe chart. Marginally above this, the bulls will experience more resistance at $0.33 (broken support). XRP’s breakout point is at $0.34, trading past this level will allow buyers to gather strength and focus on the psychological $0.4.

XRP/USD 1-hour chart