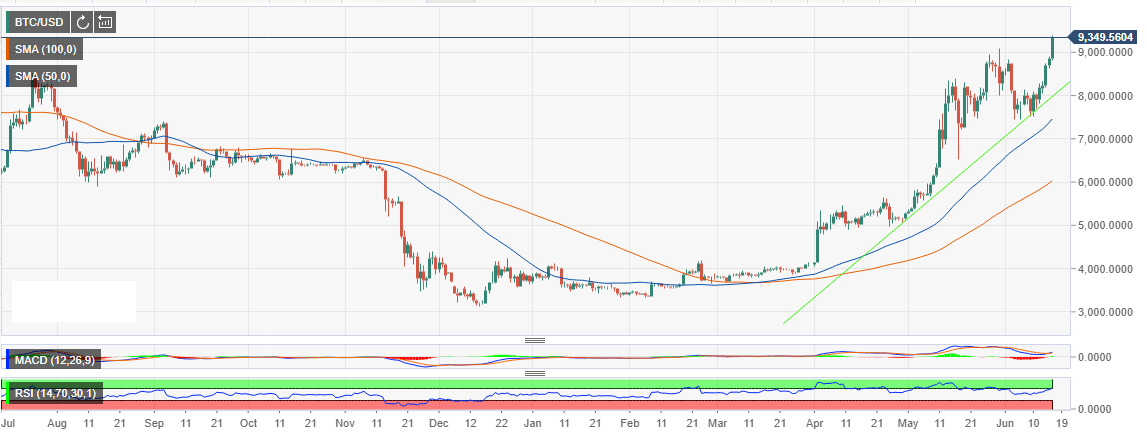

- Bitcoin sustained a higher low and a higher high pattern from the lows traded in March.

- The stalling at $9,300, leaves guessing when the retracement to $8,500 support will occur.

- Bitcoin is poised for shallow gains before a correction if technicals stay intact.

Bitcoin has slowed down its incredible momentum to give way for altcoins to breath and stretch their muscles. Major altcoins like Ethereum and Ripple are keen to hold on to the minor gains on the day that Bitcoin hits a 13-month high. With the stalling at $9,300, traders are left guessing when the retracement to $8,500 support will occur (a trend that has been witnessed with Bitcoin price action in the last couple of months).

Looking at the 4-hour chart, we see Bitcoin having sustained a higher low and a higher high pattern from the lows traded in March. The upside correction is above a trendline which continues to function as a key support line. Moreover, from the beginning of March, Bitcoin has been trading above both the 50 Simple Moving Average (SMA) daily and the 100 SMA daily.

Meanwhile, Bitcoin is trading at $9,317 after the break at $9,000. The next resistance target lies at $9,400 but analysts say that BTC/USD likely move next is to retrace under $9,000 and even test $8,500 before reversing the uptrend towards $10,000.

On the contrary, if technical levels remain as they are now Bitcoin is poised for shallow gains before a correction. Besides, if it breaks above $9,400, we could see another rally towards $9,800 as predicted by a Fundstrat analyst.

BTC/USD daily chart