Here’s what you need to know on Thursday

Markets:

BTC/USD regained ground above $9,200 on Thursday; however the further upside momentum is limited at this stage. The first digital coin hit the intraday high at $9,265 and retreated to $9,190 by press time. BTC/USD has stayed unchanged since the start of the day and gained over 1.3% in the recent 24 hours. The coin is moving within the short-term bullish trend amid low volatility.

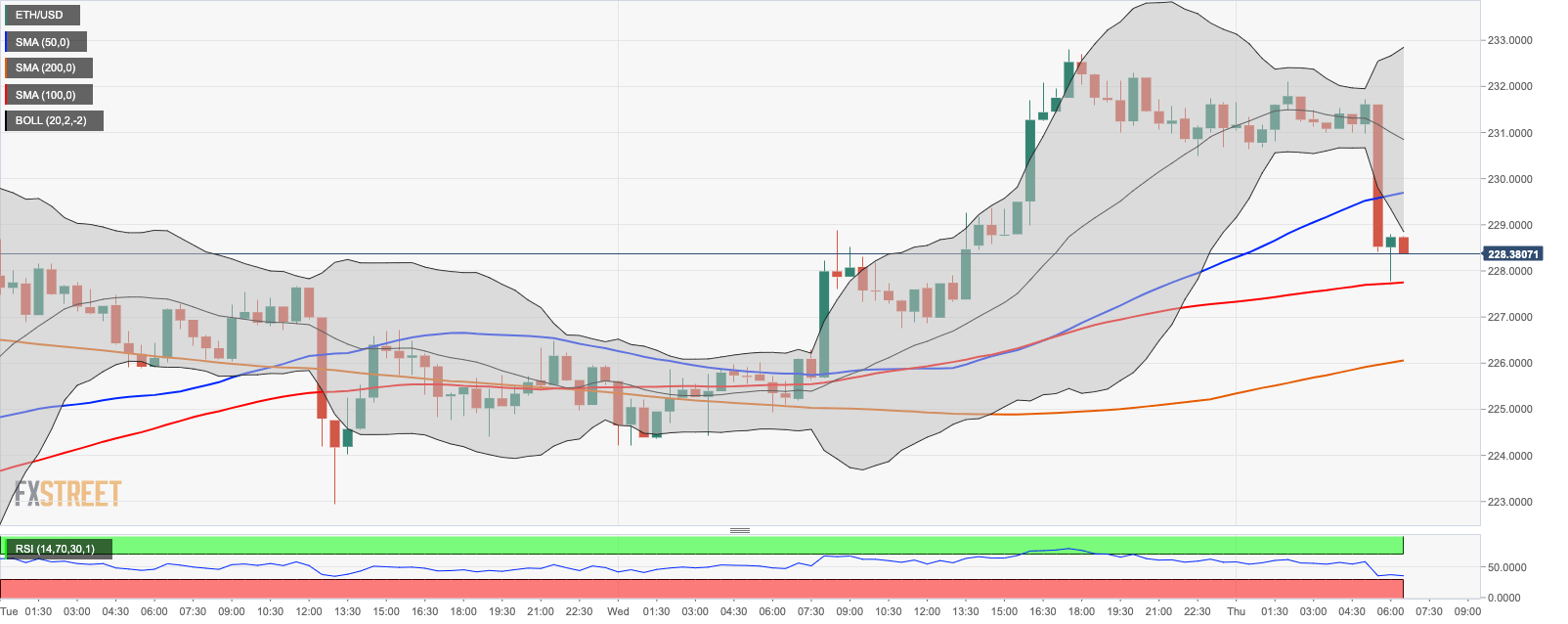

At the time of writing, ETH/USD is changing hands at $228.50. The price touched $232.10 during early Asian hours, but failed to gain the upside momentum. ETH/USD has lost over 1% since the beginning of Thursday and increased by over 2.3% in the recent 24 hours. The coin is moving within a short-term bearish trend amid expanding volatility.

XRP/USD is hovering at $0.1770. The price has barely changed since the beginning of the week. Now it is moving within a short-term bullish trend amid low volatility.

Among the 100 most important cryptocurrencies, Synthetix Network Token(SNX) $2.40 (+23.12%), Kyber Network (KNC) $1.48 (+18.5%), BitTorrent (BTT) $0.00034 (+15.5%). The day’s losers are Quant(QNT) $7.78 (-11.55%), Celsius(CEL) $0.4326 (-10.5%), Compound(COMP) $193.96 (-8.83%),

Chart of the day:

ETH/USD, 30-min chart

Markets

Bitcoin gained ground in Wednesday following a somewhat positive job report in the US, that reflected the job growth in the worst-hit sectors of the economy. According to the ADP National Employment Report, the economy added 2.4 million jobs last month with 70% of the growth coming form leisure, hospitality, trade, and construction industries. The positive news pushed the stock indices higher and helped BTC to recover above $9,200 amid improved market sentiments.

According to the data, provided by U.K crypto trading app Mode, both older and young generations significantly increased their Bitcoin investments during the COVID-19 pandemic. Thus, the trading volumes from those generations increased by 2.24x in March, 4.49x in April, and 8.88x in May as compared to February levels. Mode Chief Product Officer Janis Legler commented:

We believe these to be very interesting findings, and although the reasons for this could be manifold, they could potentially reveal an unprecedented change in the way investors think today, as a result of the global pandemic.

Industry

The Japanese financial conglomerate SBI Holdings purchased $30 million stake in the cryptocurrency OTC platform B2C2. The transaction was completed through a subsidiary of SBI Financial Services. The deal is regarded as the beginning of a strategic partnership between Japan’s largest online brokerage listed on Tokyo Stock Exchange and a digital asset trading company.

Yoshitaka Kitao, President and CEO of SBI Holdings, commented:

We expect a lot of synergies with B2C2, a firm which has a large number of clients globally and offers abundant liquidity, excellent price competitiveness, and a diverse suite of products for their customers. We will work to develop innovative new crypto products and deepen synergies across our group of companies.

Peer-to-peer Bitcoin exchange LocalBitcoins published the financial results for 2019 that proved strong financial position of the company. While the platform has been mired int money-laundering scandals and lost the market share to its closest rival Paxful, it is still one of the most popular cryptocurrency exchanges in the world. The platform registered 1.46 million new customers in 2019 and €2.48 billion ($2.79 billion) worth of trades.

The CEO of LocalBitcoins Sebastian Sonntag commented in a statement:

The rapidly growing new customer numbers naturally are a sign of a healthy demand and great future potential for LocalBitcoins. As expected, undesired activity was driven away from the platform and the implementation of KYC itself was a challenging process. Despite these, we were able to deliver growth and excellent earnings.

Regulation

The Russian court excluded cryptocurrency from the criminal case. Petrograd District Court of St. Petersburg ruled that Bitcoins and other types of assets based on cryptographic and blockchain technology cannot be considered as objects of crime against property, as virtual assets have no legal status. The court cited the information from the Bank of Russia that virtual assets are not considered as a means of payment or a medium of exchange on the territory of Russia.