- Cryptos continue their consolidation and trade in narrow ranges.

- All top three digital coins are clinging to critical levels, and are ready to explode.

- Here are the levels to watch according to the Confluence Detector.

Cryptocurrencies have not moved much in recent days and have experienced a “lost weekend”, at least for traders looking to be weekend warriors. The charts show that all three are clinging to dense clusters of technical levels, serving as “magnets”.

From the technical textbooks, we know that these situations do not last for too long. But to which direction? While the trend may be unclear, the technical levels to watch on both ends of the spectrum are somewhat easier to pinpoint.

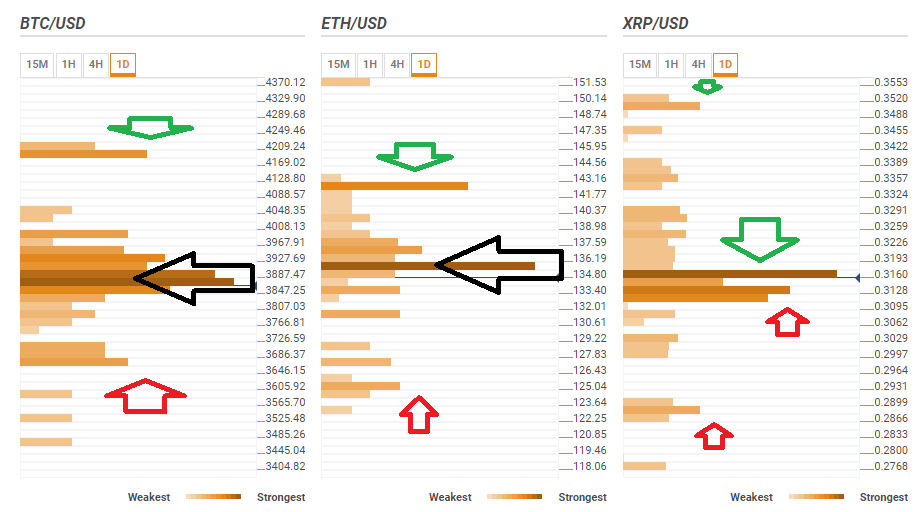

This is what the Crypto Confluence Detectorshows in its latest update:

BTC/USD clings to $3,867

Bitcoin is trading around $3,867, a major juncture of technical levels. This includes the Simple Moving Average 10-15m, the Bollinger Band 15-min-Middle, the SMA 5-1h, the Pivot Point one-day Support 1, the SMA 5-15m, the SMA 5-1d, the Fibonacci 23.6% one-day, the BB 15min-MUpper, the SMA 100-1h, the Fibonacci 38.2% one-day, the SMA 10-1h, the BB 4h-Middle, the Fibonacci 23.6% one-week, the BB 1h-Lower, the Fibonacci 38.2% one-month, and the previous day’s low.

If BTC/USD moves higher it would still have to battle through resistance all the way to $4,000 but from there is will have a clear path to $4,185where we see the meeting point of PP one-month R1, the PP 1w-R3, and last month’s high.

The same goes for the way down, where it takes time for support lines to clear out until a new target appears at $3,666 where we see the SMA 50-1d and the Fibonacci 61.8% one-month converge.

ETH/USD has a clear upside target but the downside is shaky

Ethereum‘s magnet line is $135 where we see a busy convergence including the previous daily low, the Fibonacci 61.8% one-week, the SMA 10-1d, the SMA 504h, the SMA 200-1h, the BB 15min-Upper, the SMA 10-15m, the SMA 5-15m, the BB-15min-Middle, the SMA 5-1h, and the PP one-day Support 1.

ETH/USD eyes $142 as an upside target where the previous weekly high, the Fibonacci 38.2% one-month, and the Pivot Point one-week Resistance 1 converge.

The downside is a bit wilder, with few support lines. $125 is slightly more significant as we see the BB 1d-Lower, the PP one-month S1, and last week’s low meet there.

XRP/USD has a somewhat broader range

Ripple has clearer support and resistance lines in the immediate range. $0.3160 is a hard cap. The minefield includes the Fibonacci 38.2% one-day, the SMA 50-1h, the SMA 10-4h, the SMA 200-15m, the SMA 100-1h, the SMA 5-4h, the SMA 10-1d, the SMA 5-1d, the Fibonacci 61.8% one-week, and the previous 4h-high.

Support awaits at $0.3095 which is the confluence of the Fibonacci 38.2% one-week, the BB 4h-Lower, the BB 15min-Lower, the PP 1d-S1, the previous daily low, the Fibonacci 61.8%, and the SMA 200-4h among others.

The high target is $0.3502 which is the meeting point of the previous monthly high and the PP 1m-R1.

The downside target is $0.2880 which is the convergence of the PP 1w-S2, the previous month’s low, and the PP 1m-S1.