- For the second day in a row, cryptos defied downbeat news, this time from JP Morgan.

- Technical levels are posing challenges to digital coins.

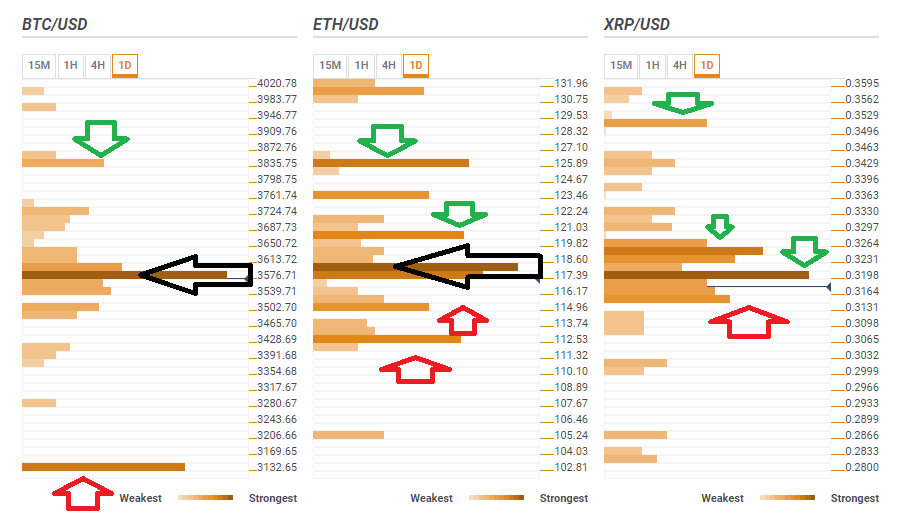

- Here are the levels to watch according to the Confluence Detector.

Earlier in the week, cryptocurrencies defied the news that the CBOE withdrew its request for a Bitcoin ETF. The move was triggered by the ongoing government shutdown and may be temporary, but yet another delay is never good news for cryptocurrencies.

Nevertheless, digital coins took the reports with stride, showing their resilience.

And now, further depressing institutional news comes from JP Morgan. The major commercial bank led by Jamie Dimon, who has been outspoken on blockchain technology said that BTC/USD could fall below $1,260. This would represent a loss of roughly two-thirds of its value.

Analysts from the influential bank said that the value of cryptocurrencies is still unproven and would only make sense in a total dystopia. They dismissed digital coins and said that in the event of a crisis, there are more liquid, less-complicated for hedging, investing, and transacting.

Blockchain technology did receive some positive words as a means to cut costs, but this may take quite a few years for banks to benefit.

Back to the present, bears did not benefit from these downbeat words. When something does not fall on bad news, it is set to rise on good news.

BTC/USD still battles $3,577

Bitcoin, the King of Cryptos, is trading in a narrow range, struggling around $3,577, a “groundhog day” reaction. The dense cluster consists of the following technical lines: the Bollinger Band 4h-Middle, the Simple Moving Average 50-1h, the SMA 200-15m, the Fibonacci 38.2% one-month, the SMA 100-15m, the SMA 5-15m, the SMA 10-15m, the BB 15min-Middle, the BB 1h-Middle, the SMA 5-1h, the Fibonacci 38.2% one-week, the SMA 5-4h, the SMA 100-1h, the Fibonacci 38.2% one-day, the BB 15min-Upper, and more.

If the granddaddy of digital coins overcomes this level, it can run to around $3,850 where we find the convergence of the Pivot Point one-week Resistance 2 and the Fibonacci 61.8% one-month.

Looking down, the only substantial support for BTC/USD is around $3,132 where the yearly low meets the PP one-month Support 1.

ETH/USD struggles with $118

Ethereum is also battling a dense cluster of levels. The $118 region is humming with stringent levels including the BB 1h-Middle, the BB 15min-Middle, the SMA 5-1h, the SMA 50-1h, the SMA 200-15m, the SMA 10-1h, the Fibonacci 23.6% one-day, the SMA 50-15m, the SMA 100-1h, the BB 4h-Middle, the SMA 5-1d.

The next target is $120.50 is the confluence of the SMA 50-4h, the SMA 200-1h, the BB 4h-Upper, the SMA 50-1d, and the SMA 10-1d.

Looking further above, $125 features the Fibonacci 61.8% one-week.

On the downside, support for ETH/USD awaits at $115 which is both last week’s low and yesterday’s low.

Further down, $112.50 is a juncture including the Fibonacci 161.8% one-day, the Fibonacci 61.8% one-month, and the Pivot Point one-day Support 2.

XRP/USD has an uphill battle at $0.32

Ripple remains restricted at around $0.32. It is the convergence of a long list of technical lines including the SMA 5-15m, the SMA 200-15m, the SMA 50-1h, the Fibonacci 38.2% one-day, the SMA 10-15m, the BB 1h-Middle, the BB 4h-Middle, the SMA 5-1h, the BB 15min-Middle, the SMA 100-1h, the SMA 10-1h, the Fibonacci 23.6% one-day, and the SMA 5-1d.

If XRP/USD conquers that level, the next cap is quite close. $0.3250 is the confluence of the SMA 50-4h, the SMA 200-1h, the Fibonacci 23.6% one-month, and the SMA 10-1d.

Only after overcoming the aforementioned hurdles can Ripple run all the way to $0.3512 where we see the Fibonacci 38.2% one-month, and the SMA 200-4h converge.

Some support awaits at $0.3131, a juncture of lines including the Pivot Point one-month Support 1, the previous day’s low, and the BB 4h-Lower.