- Cryptocurrencies have tumbled down and are trying to find a bottom.

- News regarding the highly-anticipated Bakkt launch may boost the bulls.

- Here are the next levels to watch according to the Confluence Detector.

Consolidation has ended in a climbdown – not a recovery. After several days of limited movements, digital coins have succumbed to selling pressure with Bitcoin falling below $9,500, Ethereum cracking under $170, and Ripple struggling with $0.2500.

Can cryptocurrencies climb back up? Bulls are licking their wounds and a ray of light comes from the upcoming launch of Bakkt. While the official debut is due on September 23, clients may begin making warehouse deposits as early as September 6 – next Friday.

Bakkt enables settling Bitcoin futures physically – a stark difference from the Chicago Mercantile Exchange (CME) which are cash-settled. The launch may draw more money to cryptocurrencies.

What levels should we watch?

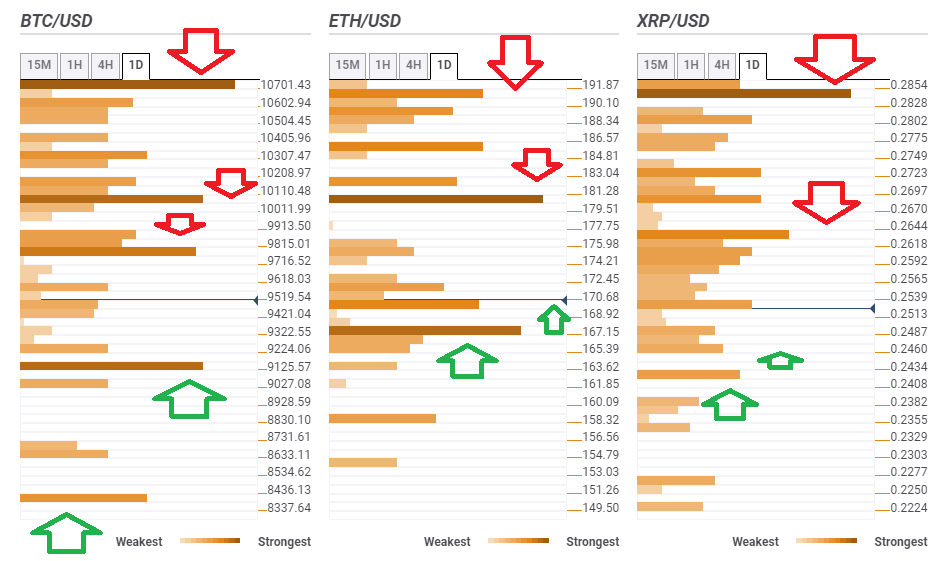

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD has a hurdle before $10,000

Bitcoin is facing resistance at $9,870, where we see the convergence of the Simple Moving Average 5-4h, the Fibonacci 23.6% one-day, and the previous weekly low.

Further up, $10,050 caps the granddaddy of cryptocurrencies, where we see the meeting point of the SMA 100-1d and teh Fibonacci 23.6% one-month.

The upside target is $10,700, which is where the Fibonacci 38.2% one-week and the Fibonacci 23.6% one-week converge.

Support awaits BTC/USD at $9,125, where the previous monthly low meets the Pivot Point one-day Support 2.

The next cushion is only at $8,390, where the PP 1m-S1 hits the price.

ETH/USD needs to recapture $180

Ethereum is looking for some support at $170, where we see the convergence of the SMA 5-15m, the PP 1w-S2, the SMA 5-1h, the BB 15min-Middle, and the previous 1h-high.

The next cushion for Vitalik Buterin’s creature is at $167, where the previous 4h-low and the PP 1m-S1 meet.

Resistance awaits ETH/USD at $180, which is the Fibonacci 61.8% one-day, the previous weekly low, and the SMA 10-4h.

The high target is $191, where we see the confluence of the previous monthly low and the SMA 100-4h.

XRP/USD has little support

Ripple is in trouble – lacking significant support. It may find a cushion at $0.2460, where the PP 1d-S1 and the BB 1h-Lower converge.

Further down, $0.2410 is where the PP 1w-S2 meets the price.

Resistance is more significant for XRP/USD. At $0.2618, we see the confluence of the PP 1m-S1, the Fibonacci 61.8% one-day, and the SMA 10-4h.

The upside target is $0.2840, where the previous monthly low, the Fibonacci 11.8% one-day, and the Fibonacci 23.6% one-week.