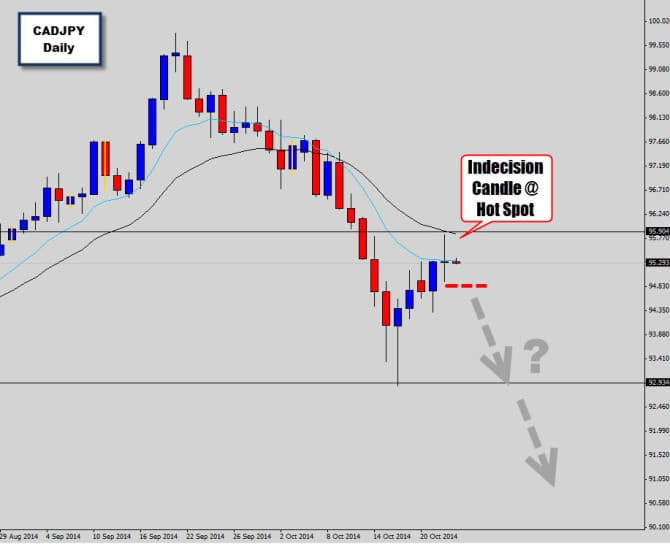

The CADJPY market has been falling under pressure every since the prior uptrend over extended, and was exhausted. The CADJPY has fallen into a strong weekly level where the market found strong support. The daily chart printed a bullish rejection candle and pushed prices higher in what appears to be a correctional move.

The countertrend correction is showing signs of termination, and is signaling a potential reversal. The daily time frame printed an indecision candle last session has the market ‘stalled and churned’ under a bearish ‘hot spot’ – and area where the mean value coincides with an important level. If the market breaks the low of the Indecision Candle, we could see the downward momentum continue and push the market back down to test the weekly support level. Here we need to watch for possible exit signs – if the level holds it could double bottom out, but if it we see a break there is a lot of potential for much further downside movement.