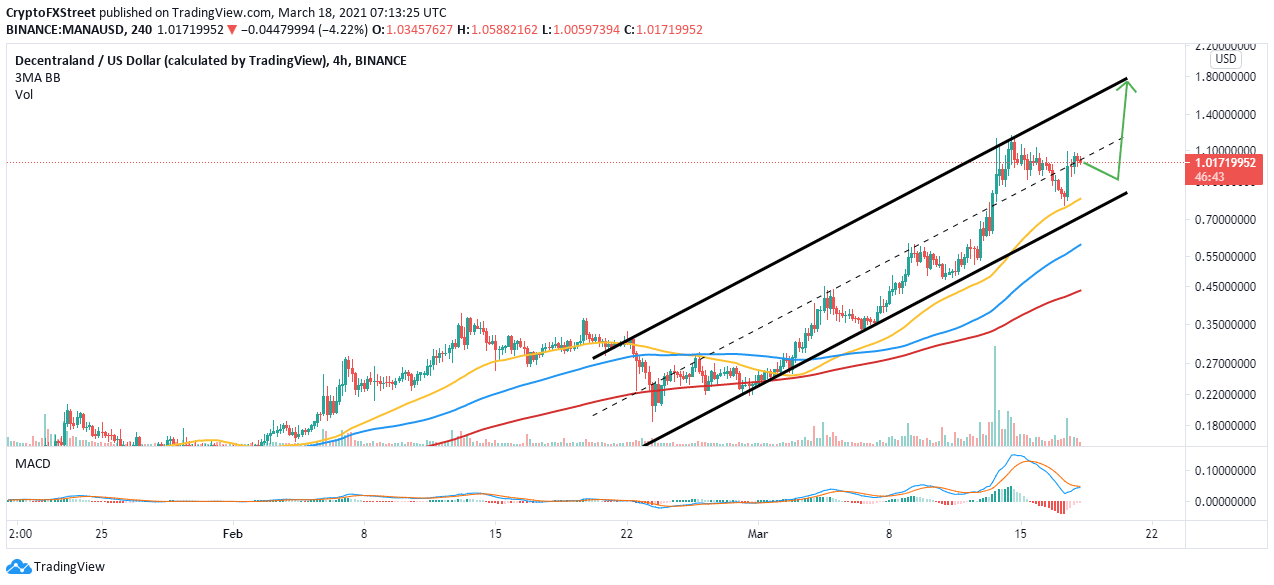

- Decentraland is pivotal at the ascending channel’s middle boundary while looking forward to another liftoff.

- The MACD will flip bullish if it crosses above the signal line.

- A significant correction may come into the picture if MANA loses the 50 SMA support on the 4-hour chart.

Decentraland is generally in an up-trending market, following the slight dip toward the end of February. Meanwhile, upward movement has been capped under $1.4. On the downside, support has been established at the 50 Simple Moving Average (SMA) on the 4-hour chart. An upswing is likely to come into the picture in the event MANA closes the day above $1.1.

Decentraland lock-step trading eyes new all-time highs

MANA is pivotal at the ascending channel’s middle boundary. Holding above this level will be a bullish signal and will likely extend the breakout toward $1.8. Decentraland is exchanging hands slightly above $1.02 amid the bulls’ persistent push to hit another new all-time high.

The 4-hour chart highlights a bullish Moving Average Convergence Divergence (MACD). The MACD line (blue) is just about to cross above the signal line. This will encourage more buyers to join the market. An increase in the tailwind force would bolster Decentraland upwards.

MANA/USD 4-hour chart

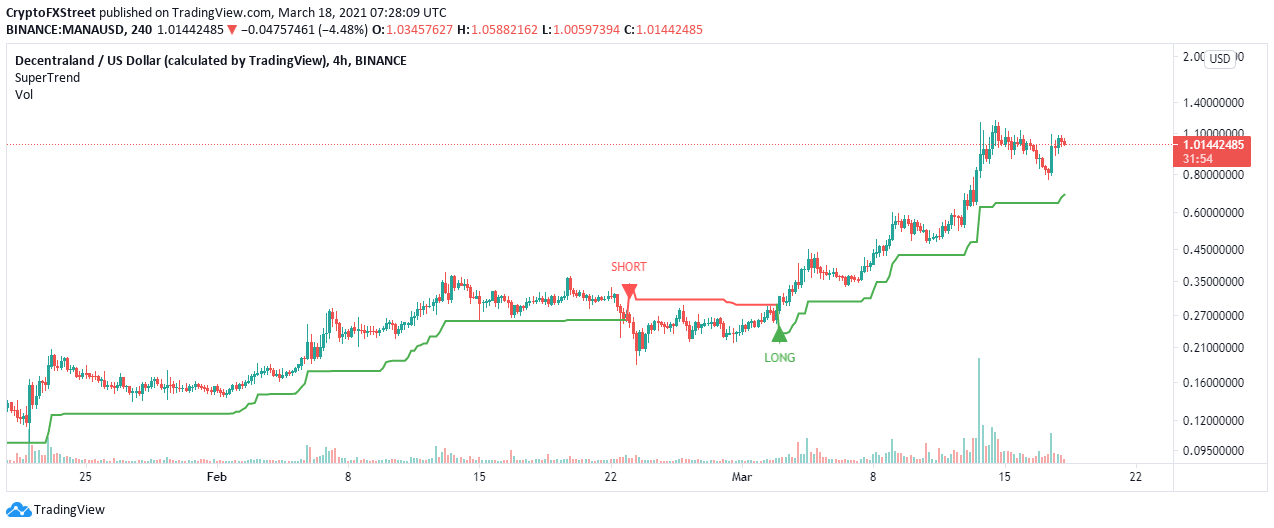

The SuperTrend indicator continues to give a bullish impulse, reinforcing the potential upswing to new all-time highs. This indicator is used to identify the general market trend. It also shows when to go long or short on an asset. If the SuperTrend indicator stays green and under the price, Decentraland will renew the bullish momentum.

MANA/USD 4-hour chart

Looking at the other side of the picture

Decentraland must hold at the channel’s middle boundary on the 4-hour chart to ensure that the uptrend is sustained. However, the 50 SMA will absorb the selling pressure if losses extend toward the channel’s lower boundary. A significant correction may come into the picture in the event overhead pressure intensifies in the coming sessions.