Idea of the Day

The main standout in overnight trade is the yen, which has pushed above the 101.50 area once again. There is a growing belief that the inflation target of 2% by April 2016 will not be met (indeed, there were many doubts when it was announced in April this year) and that additional easing measures will need to be introduced or the pace of current measures increased. This is linked with the flattening out of inflation expectations, referenced by comments from BoJ members overnight. The economy cannot recover long-term so long as consumers are convinced that deflation remains a threat, making them more likely to save and delay purchases. But the question is whether the BoJ is running out of steam, just as the government has in relation to the pace of structural reforms. It’s difficult to see yen weakness being sustained unless some fresh policy action is seen before the end of the year.

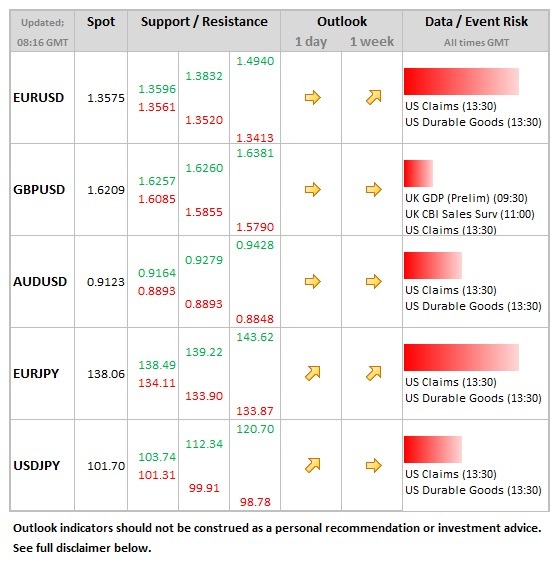

Data/Event Risks

GBP: The GDP data adds further detail to the preliminary data released in October which showed a 0.8%. The bigger concern is the balance of growth, which we’ll get further details of in today’s release. The investment and export led recovery much wished for by the Bank is likely to be lacking in today’s numbers.

USD: Weekly claims data a day earlier than expected owing to the Thanksgiving holiday tomorrow. Durable goods data also seen, but dollar moves on this are often not sustained given the volatile nature of the series.

Latest FX News

AUD:The Aussie was under pressure during most of the European session yesterday, but has managed a steadier tone overnight.

EUR: Through last week’s 1.3579 high overnight, underlining the decent underlying tone to the single currency, which has seen it outperform a more dominant dollar so far this week. Oh, and Germany has formed a government after two months of negotiations, but it’s not something that has weighed on markets.

GBP: Sterling holding up well and once again making out for a push above the top of the range that has proven to be a sticking point in the recent past, with the 1.6257/60 area the main area of resistance to the upside.

Further reading: