- The US Mid-Term elections are due tomorrow and the tension is mounting.

- The closely watched models on FiveThirtyEight show record chances for Democrats.

- The US Dollar could suffer already ahead of the results.

Americans go to the polls tomorrow, November 6th and the tension in markets is growing. While Brexit headlines try to steal the show, the outcome of the House elections is causing a lot of speculation.

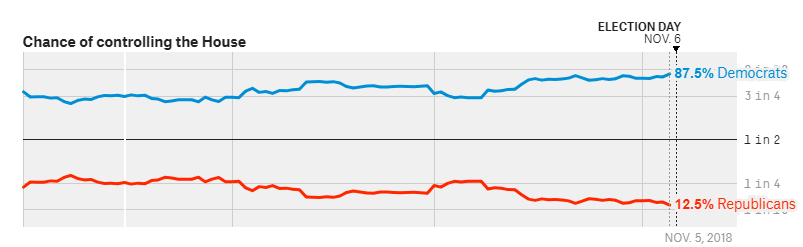

Recent updates on Nate Silver’s FiveThirtyEight website point to record chances for Democrats to gain control of the House of Representatives. According to the Classic Model, the probability of a Democratic win has risen to 87.5%, the highest on record.

The probability ranged around 84-86$ earlier. According to the model, the average gain for Democrats is 39 seats, above the 23 needed. This model considers fundraising, past voting, historical trends, etc.

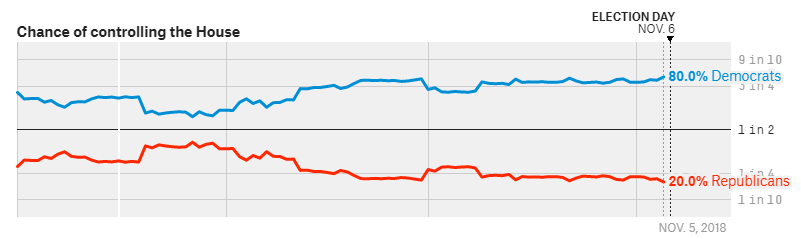

The bare-bones “Lite” model looks only at polls and also here we see a record probability of 80%, the highest so far.

USD

Markets liked Trump’s tax cuts and deregulation and all this will come to a halt if Democrats win the House. They are also likely to open investigations into Trump’s business dealings. The US Dollar will likely suffer if Democrats win and jump if Republicans retain the House.

With growing chances for the opposition party, the US Dollar may start retreating before results are known. It is important to stress that the level of uncertainty is quite high.

More: What the US mid-term elections mean for currencies: everything you need to know