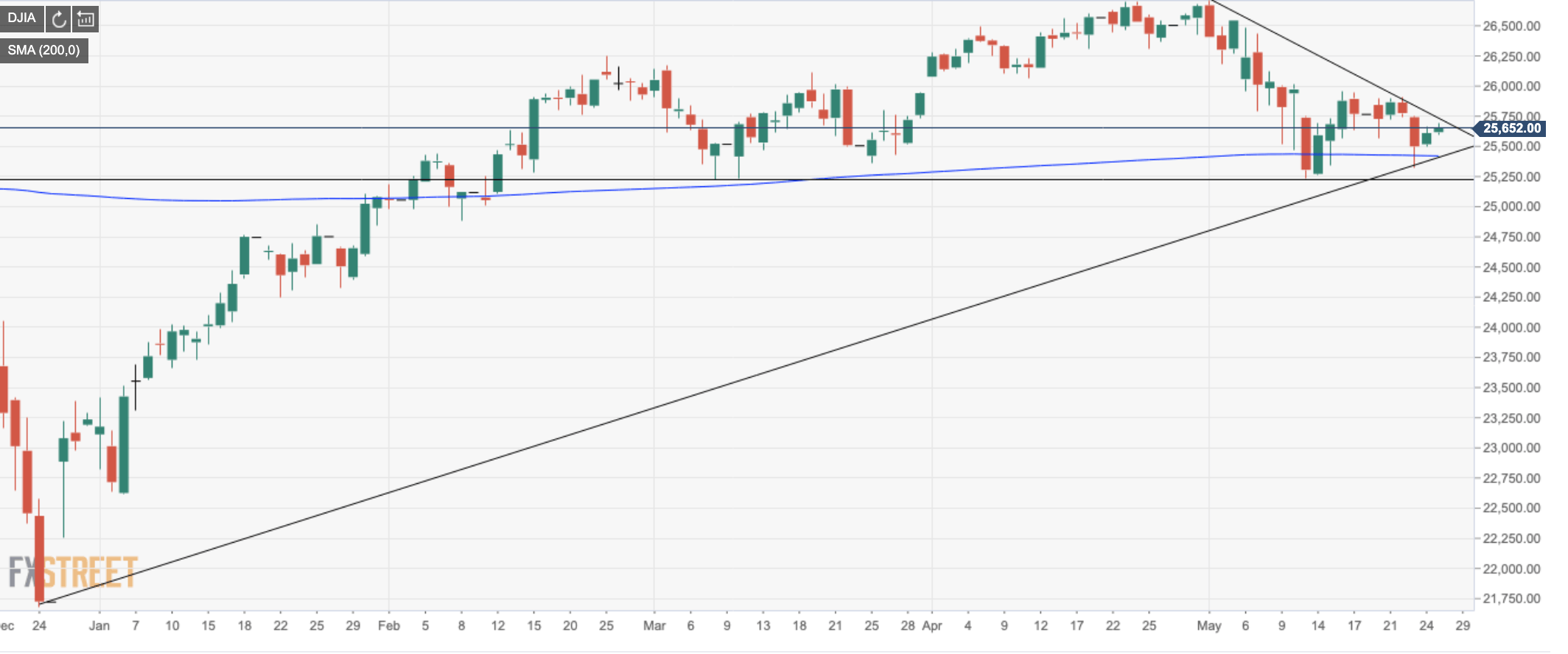

- The DJIA consolidated on the 200 DMA and at the 50% Fibo retracement of 10th May highs and 13th May swing low.

- While below the 26000 psychological target, (50% Fibo of May swing high low range), short term stochastics have corrected higher again as the price recovers from the lows and a break above 50% Fibo and 25620s, the descending resistance could be a challenge ahead of the 61.8% Fibo and 25700s.

- Bulls would then target an eventual break of 26000 which opens the 38.2% Fibo target at 26126 ahead of the 26300s, around the Nov and Fed peaks.

- To the downside, a break out of the triangle and below support line at 25250, bears can look to a run to the 24500s and then 50% of the upside run made at the end of Dec at 24150.