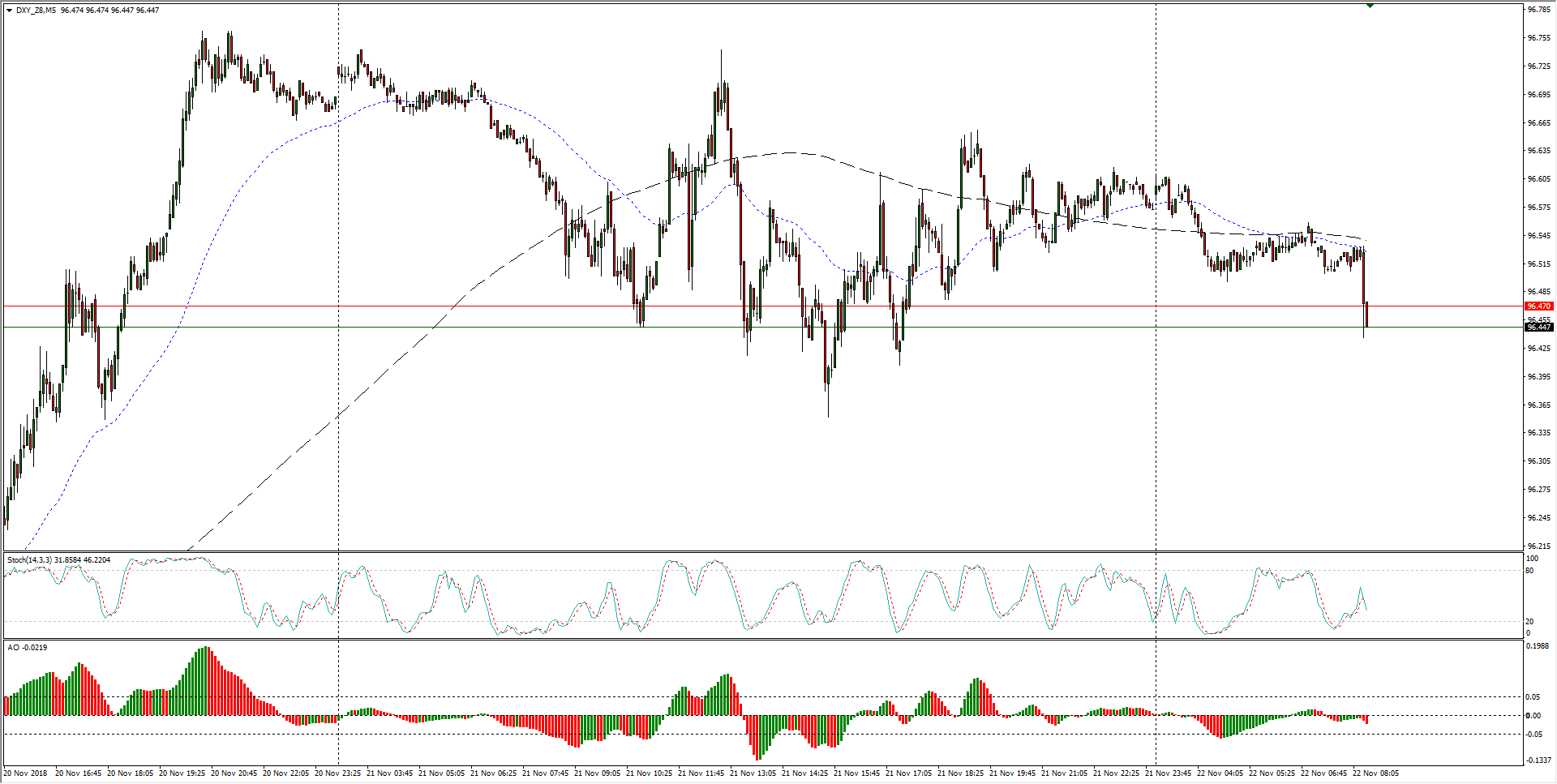

- Over the past twenty-four hours, the Dollar Index has failed to generate a meaningful bullish play, and the sideways action sees the DXY prone towards intraday drops into the 96.40 region.

DXY Chart, 5-Minute

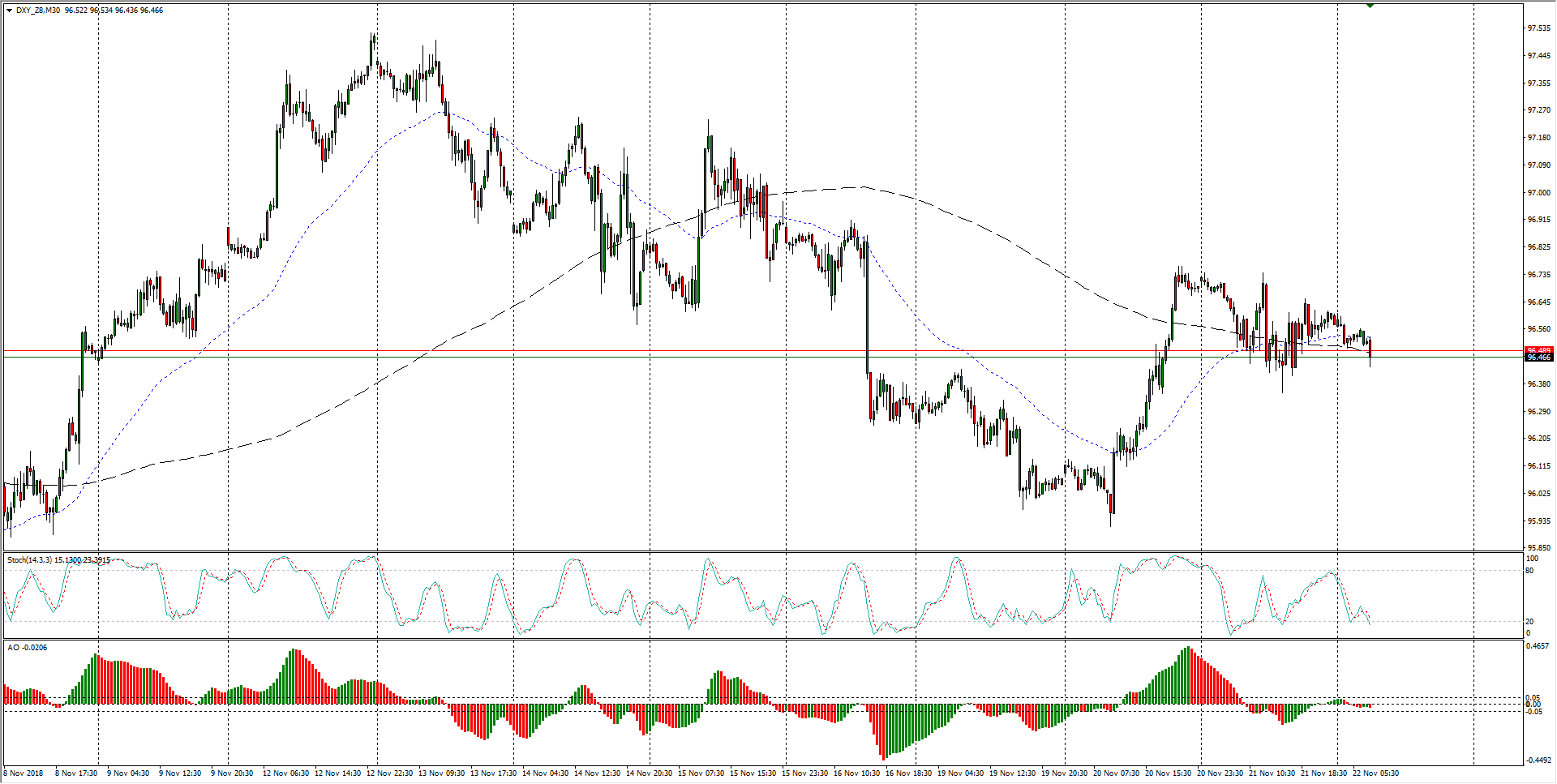

- The last two weeks see the Dollar Index drifting towards the downside, but intermittent bouts of Dollar-bidding is keeping the DXY chart roughshod through 30-Minute candles.

DXY Chart, 30-Minute

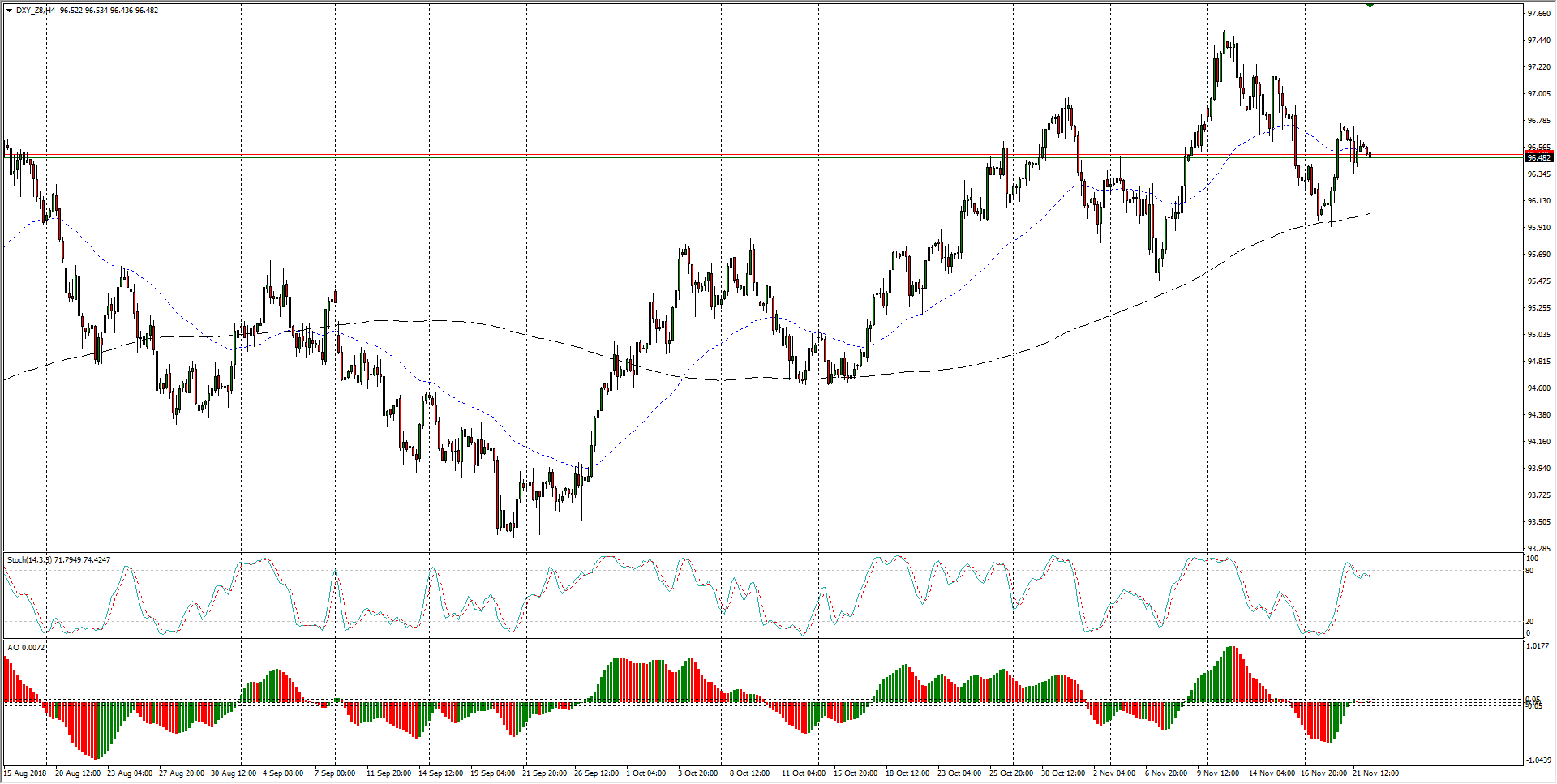

- In the medium-term, the US Dollar is catching mid flows into successive higher lows, but volatility is on the rise as reversals become a common pattern.

DXY Chart, 4-Hour

Dollar Index Spot

Overview:

Last Price: 96.64

Daily change: -8.0 pips

Daily change: -0.0827%

Daily Open: 96.72

Trends:

Daily SMA20: 96.7

Daily SMA50: 95.79

Daily SMA100: 95.43

Daily SMA200: 93.64

Levels:

Daily High: 96.87

Daily Low: 96.49

Weekly High: 97.7

Weekly Low: 96.4

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 96.64

Daily Fibonacci 61.8%: 96.72

Daily Pivot Point S1: 96.52

Daily Pivot Point S2: 96.31

Daily Pivot Point S3: 96.14

Daily Pivot Point R1: 96.9

Daily Pivot Point R2: 97.07

Daily Pivot Point R3: 97.28