USD: The U.S. Dollar opened steady this morning in Asia, with the U.S. Dollar Index rising to 83.0480 mid-session but then subsequently declining to its current level of 82.9640, down -0.280 or -0.03 percent. With the exception of the New Zealand Dollar, the Greenback is currently down against all the other majors. With respect to data, U.S. ISM Non-Manufacturing PMI came out with a reading of 59, beating the consensus of a 57 print. Additional data coming out later today includes Factory Orders (+10.9%), and the Fed’s Beige Book is also due out.

EUR: The Euro is trading fractionally higher against the Dollar and mixed against the other majors this morning after Spanish Unemployment Change showed an increase of only +8K versus an expected rise of +25.5K. Today’s data includes Spanish Services PMI (55.5), Italian Services PMI (51.7) and EZ Retail Sales (-0.3%).

GBP: Sterling softened earlier today against the majors after a new poll raised concerns of Scottish independence at the upcoming referendum on September 18th. Also, UK Construction PMI beat forecasts by printing at 64 versus the 61.5 that was expected. The BRC Shop Price Index declined -1.6% versus a previous reading of -1.9%, and Services PMI (58.6) is due out later today.

CHF: The Swiss Franc is trading moderately higher against the U.S. Dollar this morning despite Swiss GDP coming out at 0.0% versus an expected increase of +0.5%. No Swiss data is due out later this morning.

JPY: The Japanese Yen made an eight month low against the Greenback before bouncing later in today’s session. The move came despite no significant economic data out of Japan today.

AUD: The Aussie is trading higher against the U.S. Dollar this morning after Australian GDP increased +0.5% versus the +0.4% expected. RBA Governor Glenn Stevens will be speaking later this morning.

CAD: The Loonie is higher against the U.S. Dollar this morning, with no data released yesterday. The BOC will release its benchmark Overnight Rate and Rate Statement later today.

NZD: The Kiwi continued trading lower this morning against the Greenback, despite no economic data being released for New Zealand today.

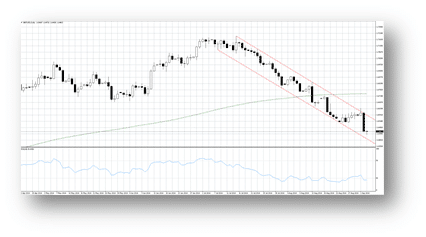

Highlighted Chart of the Day: GBP/USD

A daily bar chart of the GBP/USD currency pair appears above illustrating the recent decline yesterday and this morning. The rate fell sharply to a new recent low after failing to sustain an upside break from its notable medium term down channel bounded by the converging red trend lines. The rate is also extending its divergence below its recently broken and now flat 200 day Moving Average shown in green. The rate’s oversold 14 day RSI appears in blue in the indicator box and may impede this strong downside move, especially since it is not confirming it. (See additional technical analysis in the section below.)

Technical Analysis for the Majors

EUR/USD: The Euro traded above its 1.3114 recent low thus far this morning, keeping within a rather tight 1.3121-1.3135 range. It is still trading far below its falling 200 day MA now at 1.3628, and its 14 day RSI remains oversold at the 23.5 level. Resistance is seen at 1.3135/51 and in the 1.3220/41 region, while support shows at 1.3114 and 1.3104. Outlook is neutral in the near term but bearish medium term.

USD/JPY: USD/JPY made another new recent high this morning at the 105.30 level after exceeding resistance at 104.91, but it failed to exceed the 105.43 resistance level and instead came off sharply to 104.91. Support is noted at 104.77, and in the 104.12/26 and 103.49/55 regions. The rate’s 14 day RSI remains in overbought territory at 74.3, but it did not confirm today’s new high, which may have led to the subsequent sell-off. The rate remains above its gently rising 200 day MA currently situated at 102.35. Outlook is near term bullish and mildly bullish medium term.

GBP/USD: Cable pushed a bit lower this morning to 1.6444 after yesterday’s sharp sell-off started just ahead of an important falling channel top now drawn at 1.6589. The parallel lower channel line now supports the rate at 1.6408. The rate’s 200 day MA remains flat at 1.6754, while its 14 day RSI went into oversold territory at the 25.9 level without confirming the recent low. Resistance shows at 1.6534 and 1.6643, with support at 1.6444.Outlook isbearish in the near and medium terms. (See highlighted chart above.)

USD/CHF: After making a new high yesterday at 0.9211,the Swissy softened as far as the 0.9185 level this morning. The rate’s 14 day RSI lies just under overbought territory at 65.5, but it has not been supportive of the recent rally. The rate is still well above its increasingly rising 200 day MA now situated at the 0.8938 level. Outlook remains bullish in the near and medium terms.

AUD/USD: The Aussie fell a bit further to 0.9262 this morning before bouncing to 0.9302, but it continues fluctuating inside a 0.9201 to 0.9538 medium term trading range. Its 14 day RSI lies in central neutral territory at the 42.5 level, and the rate remains just above its rising 200 day MA now at the 0.9213 level. Support is seen at 0.9262 and in the 0.9284/91 region, with resistance noted in the 0.9322/51 region and above that at 0.9373. Outlook has turned bearish near term and is bullish turning neutral in the medium term.

USD/CAD: The Loonie rose again this morning to 1.0941, but it remains below recent highs in the 1.0985/96 region and above solid support at 1.0859 and 1.0809. Its 14 day RSI is still situated in central neutral territory at the 53.6 level, but the rate is now testing its gently rising 200 day MA now at 1.0938 from below and an upside break could be quite bullish for the rate. Outlook is bullish in the near term and neutral turning bullish medium term.

NZD/USD: The Kiwi came off sharply yesterday to 0.8289 and against today to 0.8285 after failing to break above the upper trendline of its medium term down channel now drawn at the 0.8352 level. Its 14 day RSI is in lower neutral territory at the 33.1 level, and the Kiwi has moved further below its flattening 200 day MA now at 0.8515. Support is noted in the 0.8285/89 and 0.8330/46 regions, and at the key 0.8309 level, and resistance is seen in the 0.8388/96 and 0.8406/29 regions. Outlook is now bearish in the near and medium terms.