The US dollar seems to be on the back foot following a cautious FOMC statement and poor data. BNP Paribas says dollar bulls can keep the faith:

Here is their view, courtesy of eFXnews:

The FOMC’s 27 January statement made a subtle shift towards a more cautious message, notes BNP Paribas.

“The statement dropped language indicating that risks were balanced and instead noted that the Committee is “closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook.” The implication is that the Fed needs more time and data to determine whether risks are still balanced and whether tightening can continue,” BNPP adds.

“The Fed’s new message is a setback for USD bulls such as ourselves looking for continued Fed tightening to move rate differentials further in the dollar’s favour over the course of 2016.

However, we do not expect the USD to weaken substantially in the aftermath of the meeting and we see the outlook as still very much skewed to the USD upside,” BNPP argues.

BNPP notes the following points:

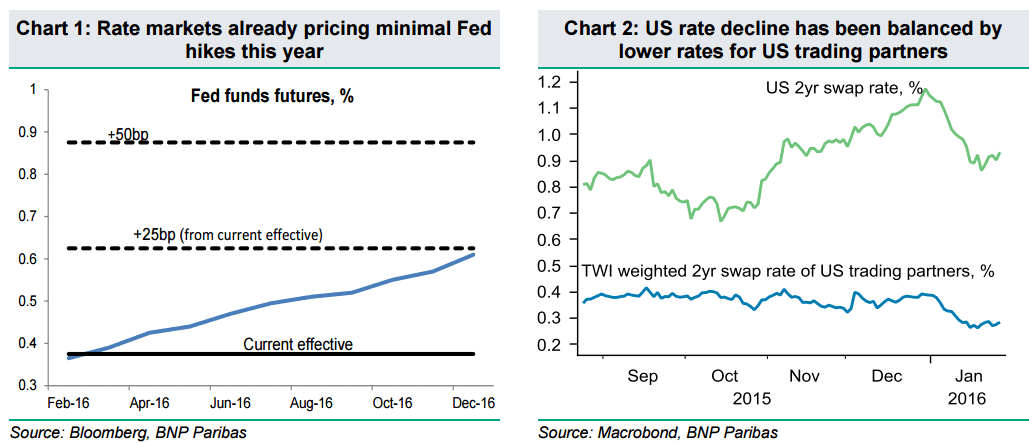

“-Markets were already priced for minimal Fed tightening heading into the meeting and have not had to adjust substantially as a result. The implied yield on the June 2016 Fed funds future was unchanged on the day (Wednesday 27 January).

-The Fed has not ruled out a March hike at all. Continued solid jobs numbers and stabilization (not necessarily even a recovery) in equity markets could see Fed pricing increase again quickly. Chair Yellen’s 10 February policy testimony is now a key focus. Our economists continue to forecast a rate hike in March and one additional hike later in 2016 (down from three hikes forecast previously), suggesting rates pricing will still need to adjust higher.

-The same factors that are making the Fed more cautious about hiking are likely pushing other G10 central banks towards a more dovish policy stance as well. This has been the message from the ECB, Bank of England and Reserve Bank of New Zealand already this month, and we could see similar signals, if not outright easing, from the Bank of Japan on Friday (29 January),” BNPP clarifies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.