- The US dollar has gotten off to a solid start in Asia.

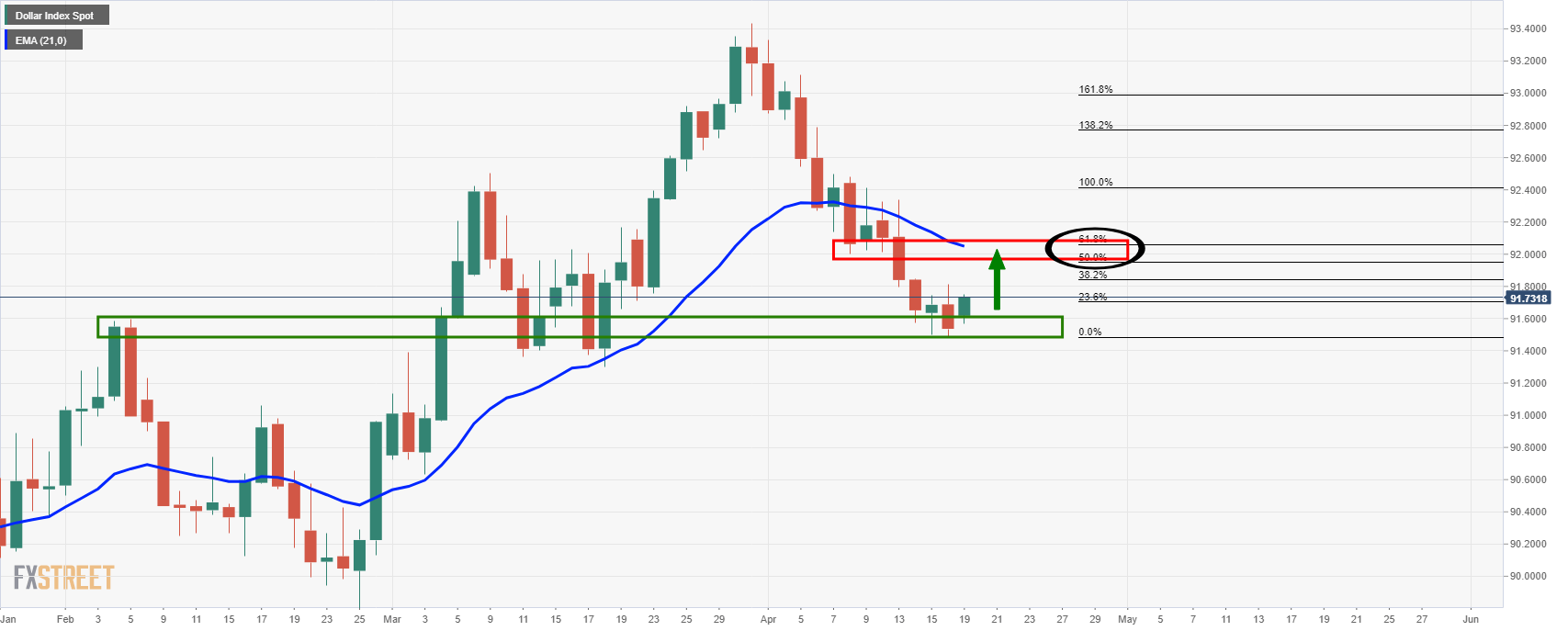

- DXY is correcting from the daily support structure.

- The focus for the week ahead will be correlations, US yields, the ECB and stocks.

The US dollar has been under pressure since the turn around in US yields following a solid first quarter.

The DXY has dropped 2.1% from a high of 93.4370 to a recent low of 91.4860.

The US10-year yields have been the main driver of US dollar weakness after losing around 14% since the 2021 tops to test the weekly 10-EMA where the price would be expected to hold and correct higher.

As for the DXY, the same could be said in terms of market structure.

DXY daily chart

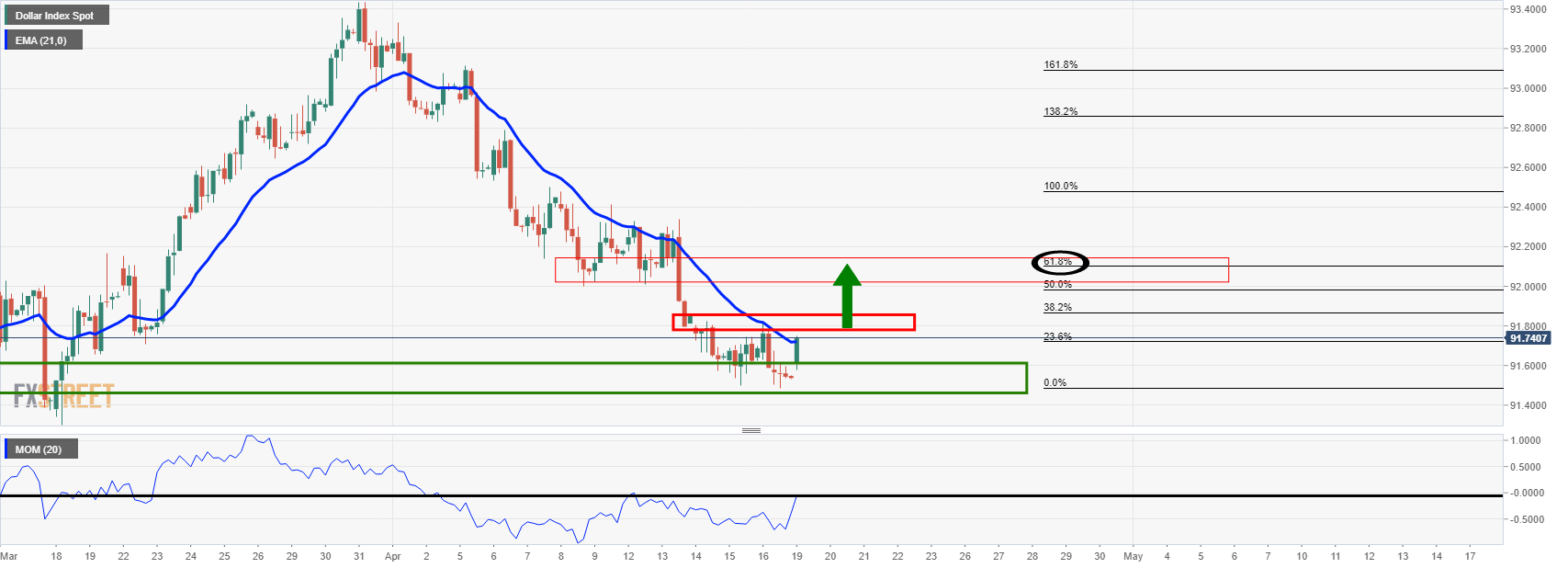

4-hour chart

The 4-hour conditions are starting to turn bullish according to the Momentum indicator and a break of the 21-EMA would also be encouraging.

ECB in focus

There’s not a lot for the markets in terms of guidance for the week ahead and the Federal Reserve media embargo kicked in at midnight last Friday.

This means that traders will get no more Fed speakers until Chair Powell’s post-decision press conference next Wednesday, April 28.

Meanwhile, this puts the focus on the European Central Bank is on the market’s radar.

Although the meeting itself is unlikely to throw up anything new into the picture, it may well encourage an emphasis back onto the decoupling between the US and EU’s economic recoveries.

The US economic recovery is gaining momentum bolstered by a sizable fiscal stimulus and a rapid vaccine rollout while the eurozone is still struggling with third Covid waves.

The Atlanta Fed’s GDPNow model suggests Q1 growth is 8.3% SAAR, while the New York Fed’s Nowcast model suggests Q1 and Q2 growth of 6.8% and 4.4% SAAR, respectively.

Headline inflation has already breached the Fed’s 2% target and core inflation is set to join shortly which could spark up a flurry in the bond markets and see yields regain a northerly trajectory again soon, prp[elling the US dollar higher.