- DXY Dollar index rises to fresh 9-month tops.

- FOMC minutes of the July meeting reveal a firm stance of QE tapering by the end of the year.

- Fed is still cautious because of inflation and employment concerns.

- Delta variant is souring the risk sentiment, helping US dollar bulls to keep the bids alive.

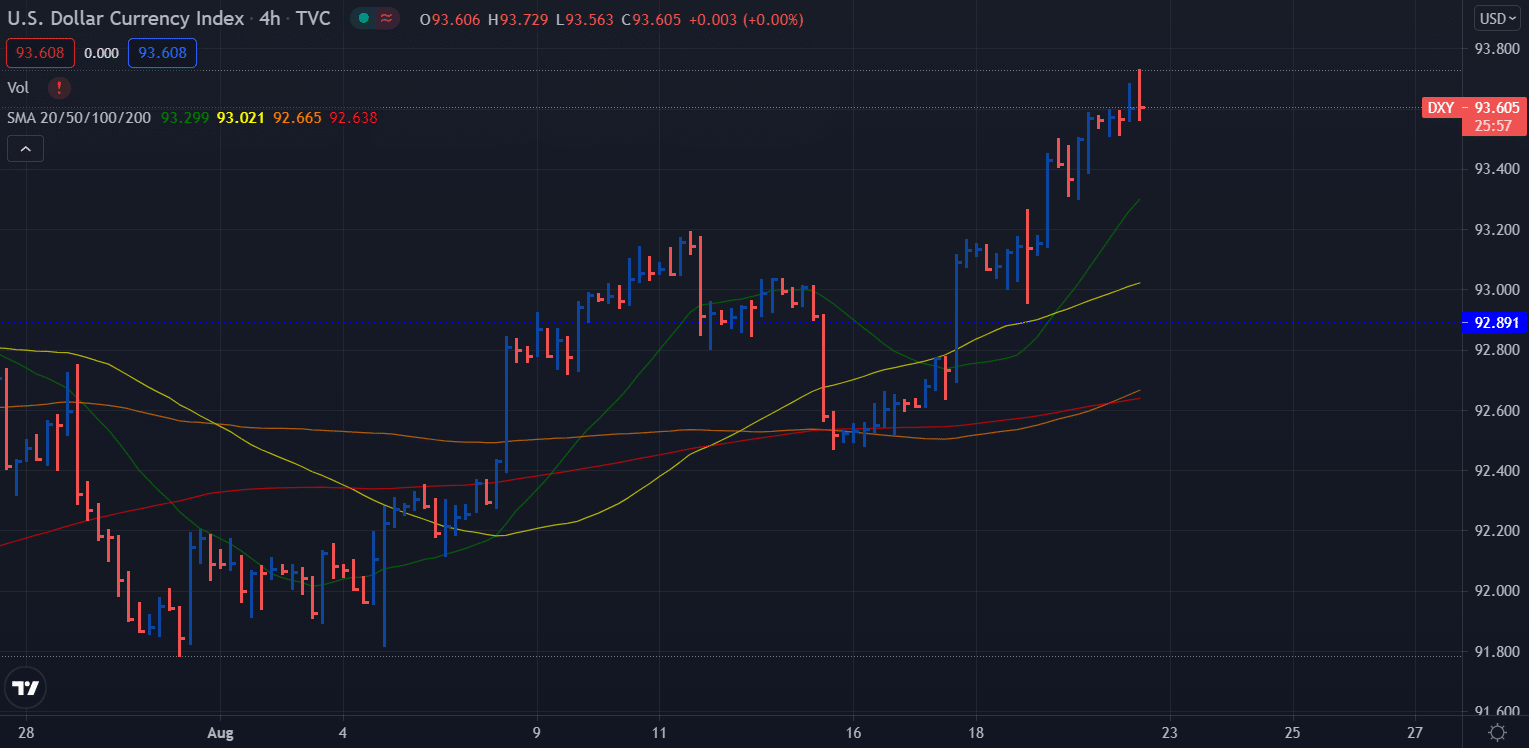

The DXY Dollar index analysis depicts an extremely bullish scenario. The index has posted fresh 9-month highs above the 93.50 area.

At the time of writing, the index has been at 93.63, up 0.07% on Friday’s New York session.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

According to the July FOMC minutes, the Federal Reserve System (FRS) can meet the standards set for QE rejuvenation, which will commence this year. Still, there is substantial disagreement among FOMC members about when QE tapering will be implemented. In addition, there were differences in their views on the economy, persistent inflation, the labor market and the risk of exiting COVID-19’s delta variant.

FOMC officials generally supported the protocol, but they expressed reservations or caution at supply restrictions and the COVID-19 variant. In addition, a wide range of opinions was expressed about inflation, ranging from temporary to persistent to the possibility of significant inflation pressures again.

COVID fears worldwide

The spreading Delta variant across the world is deteriorating the risk sentiment. As a result, the US dollar gains momentum as the investors flee to Greenback because of its safe-haven appeal. Australian infections reached nearly 700 on Thursday after reaching 758 daily infections on Wednesday. There are currently two new infections of New Zealand Covid reported in Wellington. The death toll in the United Kingdom has been rising for several days, and we see reports about deaths in the USA as well. The number of cases in China declined from 46 to 33 on Thursday.

DXY Dollar Index price analysis: Key SMAs to support

The DXY Dollar index price is stabilizing above the mid-93.00 area. The index seems to take a pause from the week’s bullish momentum. However, the bulls are still quite active and may am for the 94.00 mark.

–Are you interested to learn more about forex signals? Check our detailed guide-

The 4-hour chart of the index reveals an upthrust under development. This can lead to a correction towards 20-period SMA around 93.30. The next support lies at 93.00 near 50-period SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.