- DXY remains subdued as the Delta variant rises in the US.

- The index has lost 1% since Friday as markets doubt whether the Fed will announce tapering or not.

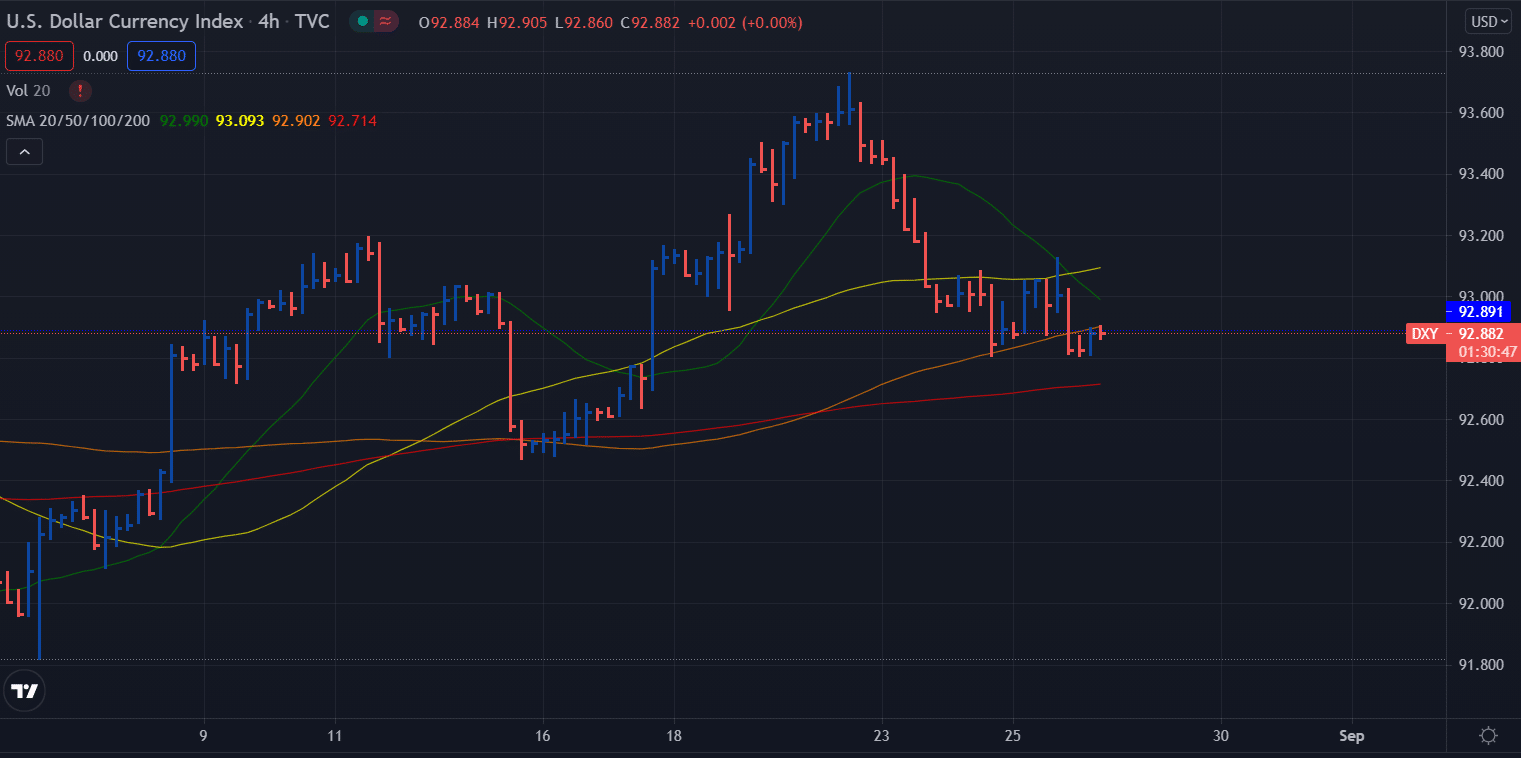

- Technically, the index is under bearish pressure below the 100-period SMA.

The DXY Dollar Index price analysis suggests further weakness as markets worry as Delta variant spreads in the US and awaits Jackson Hole.

The DXY is trading at 92.89, up 0.08% at press time on Thursday.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Powell’s position will remain unchanged if he sticks to the same scenario that we have heard over and over again in the minutes of the last Federal Reserve meeting.

This means that the US dollar is likely to be influenced by commodity currencies and EM-FX flows as part of the rebalancing trade on the foreign exchange market.

Bearish sentiment drove the broader DXY lower by nearly 1.0% since Friday. A weakening economy and global growth prospects could have prompted the Federal Reserve to postpone the timing of a cut in bond purchases.

Markets are hampering expectations that the Fed will use its annual Jackson Hole symposium to determine the shape of a contraction chart, which is why the US dollar has taken a hit and has recently lost value. In the face of the COVID-19 delta variant’s potential to impede economic recovery, widespread selling of the dollar might continue.

This led to the implied volatility in the US dollar rising in anticipation of the upcoming Jackson Hole Symposium, which will begin on Thursday, August 26. Future speakers like St. Louis Fed President James Bullard and Dallas Fed President Robert Kaplan, who will speak tomorrow, will be closely watched by traders as they try to gauge whether the Fed will behave in a hawkish or more cautious manner.

For longer-term economic projections, it is prudent to wait for chairman Powell’s remarks, set for Friday, August 27 at 14:00 GMT, before moving on.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

DXY Dollar Index price technical analysis: 100-SMA pressing down

The 4-hour chart of the Dollar Index reveals a bearish picture as the price is lying below the 100-period SMA. The index formed a hidden upthrust bar followed by no demand bars. This is a bearish indicator. However, the bears have to overcome the stiff support of 200-period SMA at 92.70. On the upside, 93.00 poses as interim resistance near the 20-period SMA. However, the bearish crossover of 20 and 50 SMAs keeps the selling pressure intact.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.