- DXY is trapped within a minor range. A valid breakout could bring us a clear direction.

- The Dollar Index needs a bullish spark to be able to resume its upside movement.

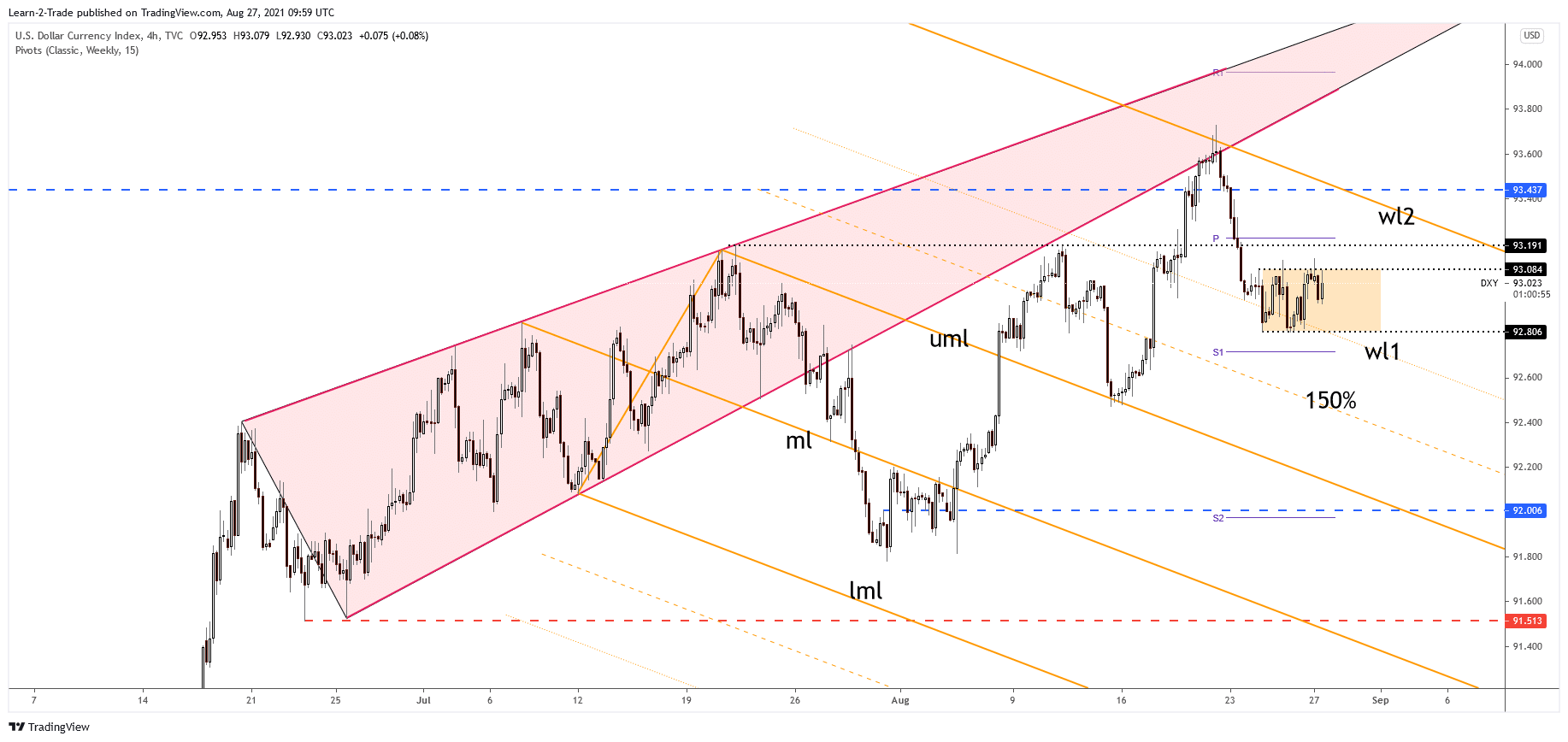

- Making a valid breakout through the second warning line (wl2) could indicate an upside continuation.

The DXY Dollar Index price moves sideways in the short term, accumulating more bullish energy before jumping towards new highs. It was into a corrective phase, but the retreat seems over. Still, today, the DXY needs a bullish spark from the US economy or the Fed Chair Powell.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

DXY seems undecided right now, so we’ll have to wait for a valid breakout from the current range. A valid breakout should bring us a clear direction. The bias is still bullish despite the most recent drop. I believe that only a new lower low could activate a larger downside movement.

The Fed Chair Powell Speaks at the Jackson Hole Symposium is seen as a high-impact event. In addition, the US is to release the Revised UoM Consumer Sentiment, which is expected to rises from 70.2 to 70.9 points, and the Core PCE Price Index could increase by 0.3%.

The US Goods Trade Balance, Personal Income, Personal Spending, and the Prelim Wholesale Inventories will be released as well. So, anything could happen around these publications. Better than expected, US data could lift the Dollar Index. This scenario indicates that the USD could appreciate versus its rivals.

DXY Dollar Index price technical analysis: Consolidation to continue

DXY price is trapped between 93.08 and 92.80 levels. Escaping from this pattern could bring a clear direction. The outlook is bullish as long as it stays above 92.80. Technically, the bullish pressure is high after its sell-off.

–Are you interested to learn more about making money in forex? Check our detailed guide-

It has found support around the first warning line (wl1) of the descending pitchfork. Now it stands right below 93.08 static resistance. An upside continuation could be activated and validated by a valid breakout above the descending pitchfork’s second warning line (wl2). 93.43 is seen as a major upside obstacle as well. Jumping and stabilizing above it may signal an upside continuation.

On the other hand, dropping below 92.80 and through the weekly S1 (92.71) signals an important downside movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.