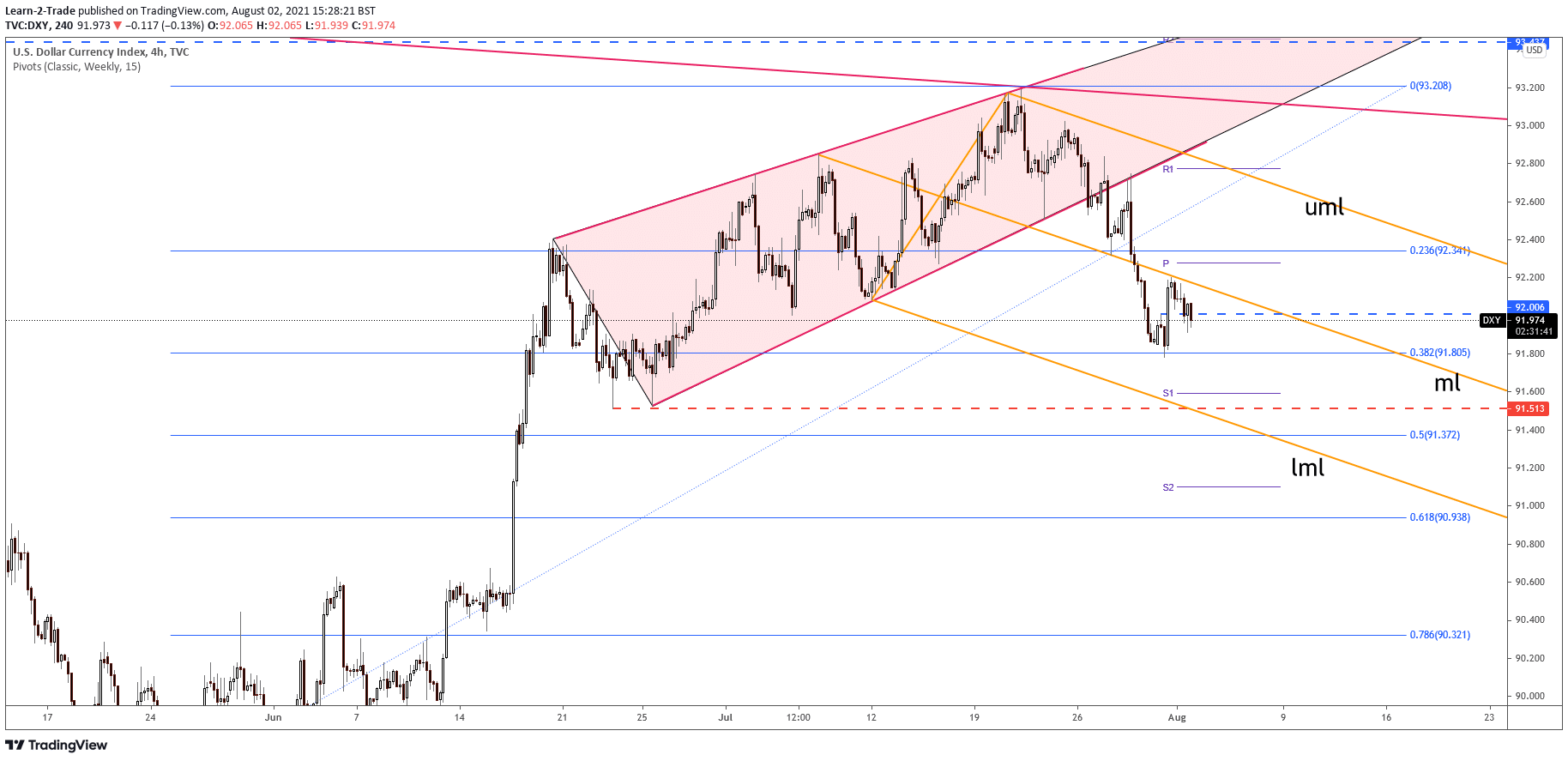

The DXY price is trading in red right now at 91.98 level above 91.91 today’s low. The index is vulnerable to slide further as long as it stays under strong obstacles. DXY’s further decline forces the USD to depreciate further versus its rivals.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Unfortunately for the dollar, the ISM Manufacturing PMI dropped unexpectedly from 60.6 to 59.5 points. The analysts have expected an increase to 60.8 points. Instead, the Final Manufacturing PMI increased from 63.1 to 63.4 points, the Construction Spending registered only a 0.1% growth versus 0.4% expected, while the ISM Manufacturing Prices dropped from 92.1 to 85.7 below the 87.9 estimates.

The US Non-Farm Payrolls, Average Hourly Earnings, Unemployment Rate, ADP Non-Farm Employment Change, and the ISM Services PMI could change the sentiment during the week. These high impact events, data could shake the markets.

DXY price technical analysis: Will bears dominate?

The DXY stays around the 92.00 psychological level. So technically, jumping and stabilizing above the descending pitchfork’s median line (ml) could signal that the correction is over. However, it has found support on the 38.2% retracement level, so only a valid breakdown through this level could really validate further drop.

The pressure remains high as long as it stays under the median line (ml). The next major downside target is seen at 91.51 and at the lower median line (LML). Failing to drop towards the weekly S1 (91.59) signals a potential bullish fly above the weekly pivot point (92.27).

–Are you interested to learn more about forex trading apps? Check our detailed guide-

A new lower low signals a broader corrective phase, while making a new high could announce a new leg higher. DXY’s drop was expected after escaping from the Rising Wedge pattern. Staying above the 38.2% level could signal that we had only a temporary decline and that the index may come back towards the 93.00 psychological level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.