- DXY is still bullish despite the temporary decline; further growth should lift the greenback.

- A valid breakdown above 93.19 signals more gains towards the uptrend line.

- The upside scenario could be invalidated only by a valid breakdown below the R1.

The DXY Dollar Index price dropped slightly, and now it stands at 93.05 level, far below 93.16 yesterday’s high. Today’s low is seen at 93.00 psychological level. However, its drop could be only a temporary one. The index could jump higher anytime if the US reported some positive economic figures.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Technically, a temporary decline was expected after yesterday’s rally. DXY is located within a resistance area. Consolidating here could bring a new upside movement. Resuming its growth signals that the greenback could resume its appreciation in the short term.

The volatility could be high today as the US is to release its FOMC Meeting Minutes. This is considered a high-impact event. Also, the Housing Starts could drop from 1.64M to 1.60M, while the Building Permits could increase from 1.59M to 1.61M.

Canada will publish its inflation figures later today. I believe these figures could bring some action on the DXY as well.

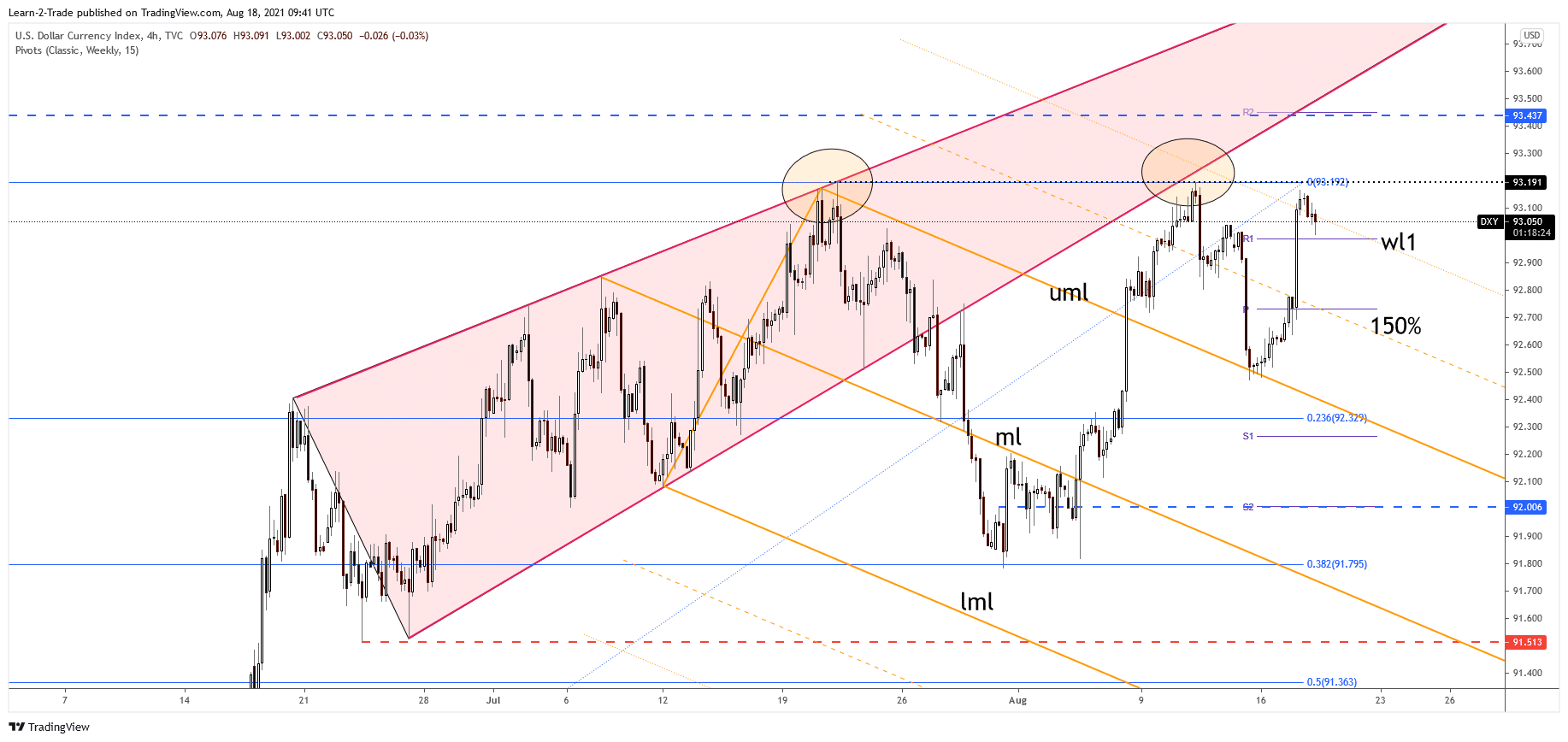

DXY Dollar Index price technical analysis: Warning line retest

The DXY price tries to stabilize above the broken warning line (wl1) of the descending pitchfork. It has failed to retest the weekly R1 (92.98), signaling strong buyers. The index was somehow expected to slip lower after failing to reach the 93.19 static resistance.

In the short term, it could move sideways, accumulate more bullish energy before resuming its growth. Stabilizing above the broken warning line may signal an upside breakout through the 93.19 upside obstacle.

–Are you interested to learn more about forex signals? Check our detailed guide-

The next major upside target is seen at 93.43 higher high, around the weekly R1 (93.44,) or higher at the uptrend line. Personally, I believe that only staying below the warning line (wl1) and dropping below the R1 (92.98) could invalidate the upside scenario.

The DXY’s further growth should help the USD to appreciate versus its rivals. EUR/USD could drop towards fresh new lows if this scenario takes shape. However, you should be careful as the FOMC Meeting Minutes could change the sentiment.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.