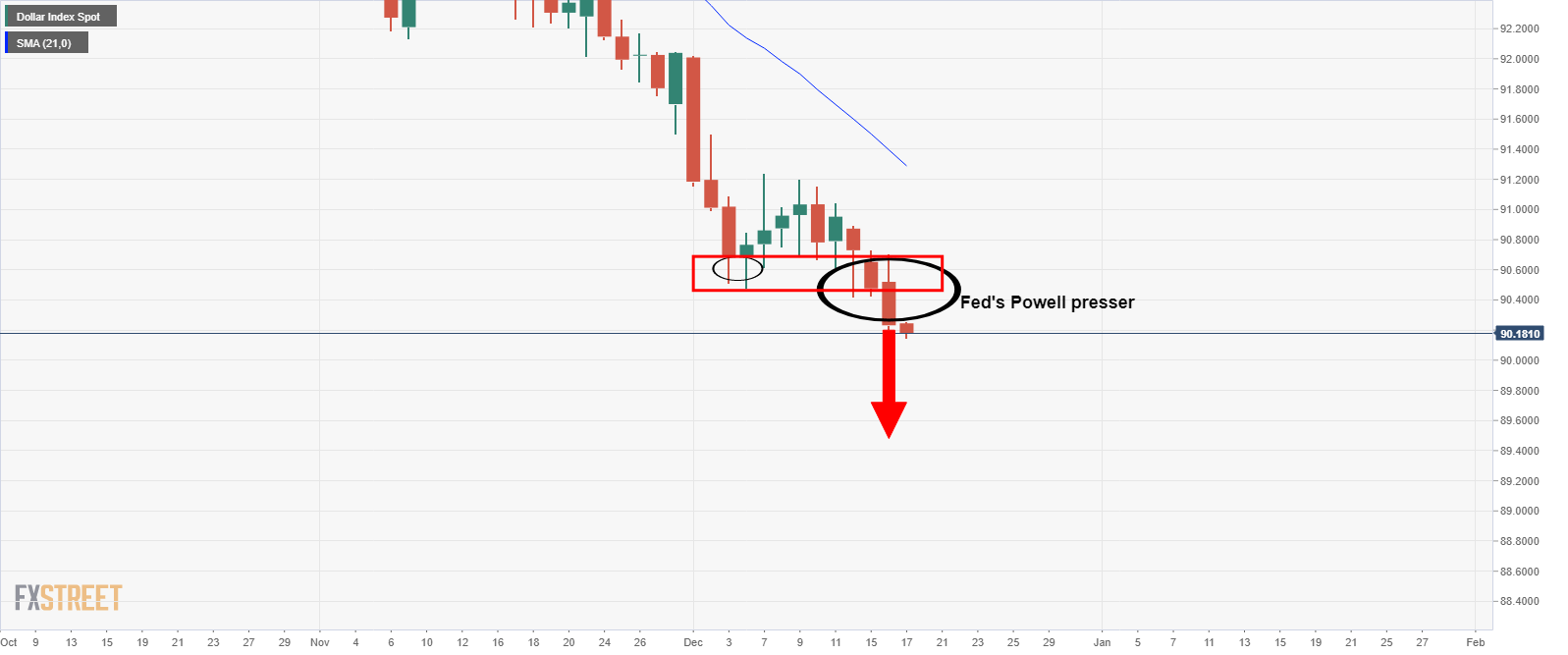

- DXY down in the doldrums following markets reaction to a mixed Fed statement.

- More shorts can be added before aggregate positioning reaches the -18% lows seen in late September.

The markets have been fixated on the Federal Reserve mid-week which had mixed reactions for the US dollar throughout the event.

Initially, the greenback found solace on guidance that stated the Fed will taper after “substantial progress” but will keep policy “accommodative” until they “achieve inflation moderately above 2 per cent for some time,” is what has investors recalibrating their portfolios.

It’s intentions to taper its QE programme were quickly met with disbelief and the dollar sank on supporting commentary and various dovishness in the statement such as the Fed ”will continue the pace of bond buys until ‘substantial’ progress on goals.”

The press conference with the Fed’s chair, Jerome Powell, was the clincher for the bears and sent the US dollar off the edge into the abyss to print fresh 2.5 year lows.

Powell’s opening statement, for instance, said, ”we will continue to provide powerful support until the recovery is complete.”

Additionally, he stated ”we have the ability to buy more bonds, or buy longer-term bonds, and may use it, and ”any time we feel like economy could use stronger accommodation we ‘would be prepared to provide it.’

”When we see substantial progress we will say so ‘well in advance’ of tapering. Lowering QE is ‘some ways off’.

As a result, the DXY is now licking its wounds as follows:

A fiscal deal is on the way and nominal yields may remain capped, keeping real rates reverting on a southerly trajectory which will continue to weigh on the USD for the near and medium-term.

Speculator’s optimism about the global recovery as vaccines are rolled out in major economies will also pressure the greenback.

Moreover, net shorts can still increase before aggregate positioning reaches the -18% lows seen in late September.