- COVID-19 is having a major impact on both the Chinese and the global economy.

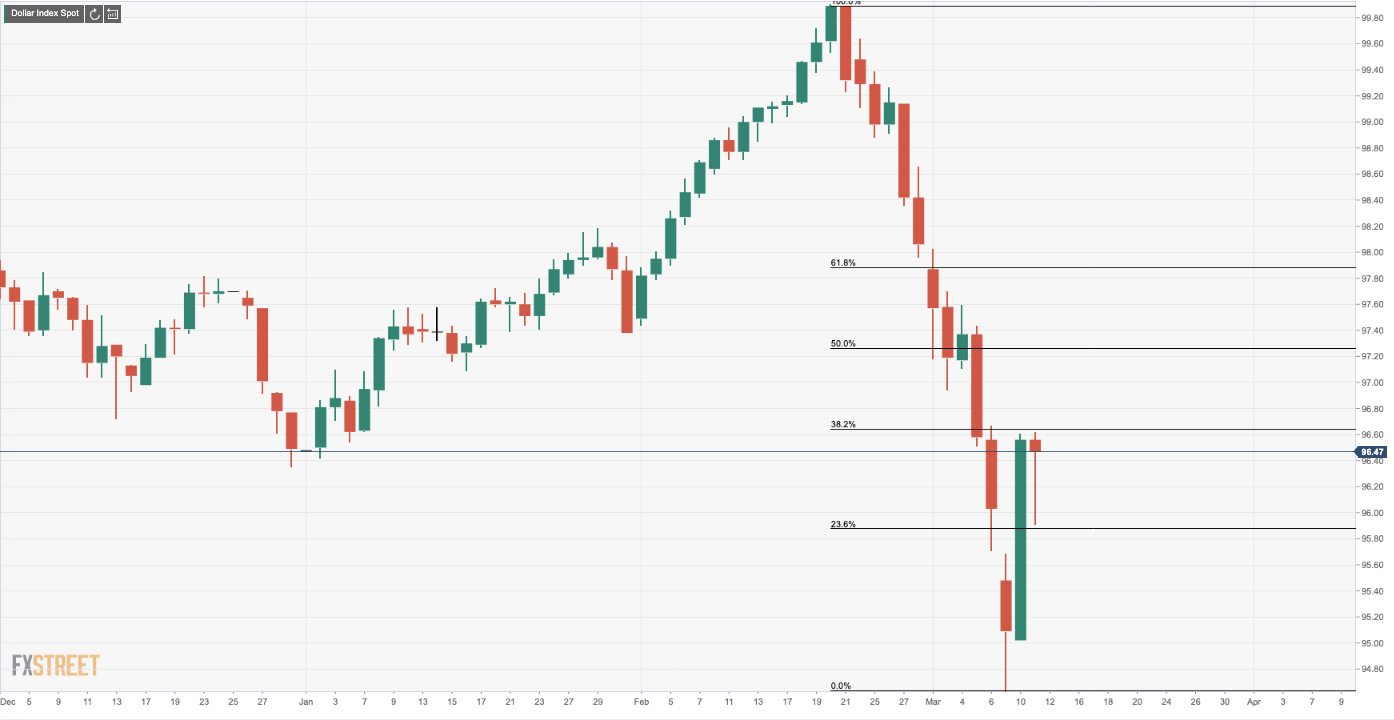

- DXY holding tight in less bearish territory having completed a 38.2% Fibo retracement.

- Bullish pin bar underpins the dollar at critical resistance.

- short-run offers some runway for the USD to consolidate against the reserve basket.

The US dollar has picked up a bid this week following an unwind of the carry trade last week and pressures in the XY from the 99 handle all the way into the lower end of the 94 handle. Markets were quick to sell out of EM-FX, which supported the euro before the Federal Reserve cut interest rates in an inter-meeting by an emergency 50 basis points. This sent US yields and the dollar plummeting.

The coronavirus spread is threatening to wipe out global growth all the way down to 1.6% in 2020 and 3.2% in 2021 according to analysts at Rabobank who summarised the outlook into key bullet points as follows:

- Apart from China, emerging markets are currently experiencing the most economic pain.

- There is a real risk that the spread of COVID-19 will be more serious than we are currently estimating in our base scenario.

- In a risk scenario of a pandemic, the economic losses in 2020 could roughly double.

- There is an additional risk that the economic crisis in the risk scenario could lead to liquidity problems at businesses around the world, which would threaten. financial stability. This is an additional risk and is not taken into account in our pandemic risk scenario.

- A robust response from the central banks and governments should prevent the virus crisis becoming a financial crisis as well.

Eyes on Fed and ECB

As well as the coronavirus, the price war in the oil market should keep risk markets at bay. However, the COVID-19 epidemic and market assessment of the Fed’s rate trajectory will likely dominate USD positioning in the near-term and the next Fed meeting is not until the 18h March. However, while national governments will be doing their best to delay the spread of the virus, the impact on people and businesses will still be ‘large and sharp’ (Mark Carney’s description this morning), the expectation is therefor for the Fed to do more which will likely continue to pressure the dollar, especially against the yen and CHF.

Having said that, the euro makes up the majority share of the basket of currencies weighted vs the greenback, therefore, there will be pressures to the upside should the euro spiral into a nosedive following whatever precautionary measures the European Central Bank will make tomorrow. On the other hand, there could be a counterintuitive response, especially if markets continue to reward currencies of nations that are seen to be proactive – fiscal stimulus measures should be supportive of the euro.

US CPI a bit stronger than expected

Meanwhile, US data today revealed the Consumer Price Index coming in a bit stronger than expected, with the 12-month change in core prices edging up, but the data remain consistent with no significant acceleration or deceleration on a trend basis. Analysts at TD Securities summarised as follows:

- The total CPI rose 0.1% m/m in February, above the 0.0% consensus; the TD Securities forecast was 0.1%. The core index rose 0.2%, which matched consensus (and the TD forecast), but the rise was a fairly solid 0.22% before rounding (consensus: 0.16%, TD: 0.19%).

- The 12-month change in the overall CPI slipped to 2.3% in February from 2.5% in January (consensus: 2.2%, TD: 2.3%). That 12-month change is likely to drop below 2% in March due to the latest plunge in energy prices. The 12-month change in the core index rose to 2.4% from 2.3%. That is above last year’s 2.3% average, albeit just slightly.

DXY levels