- The DXY sold off again on Thursday, dropping below its 21DMA.

- The index has been under pressure since breaking below a key January uptrend.

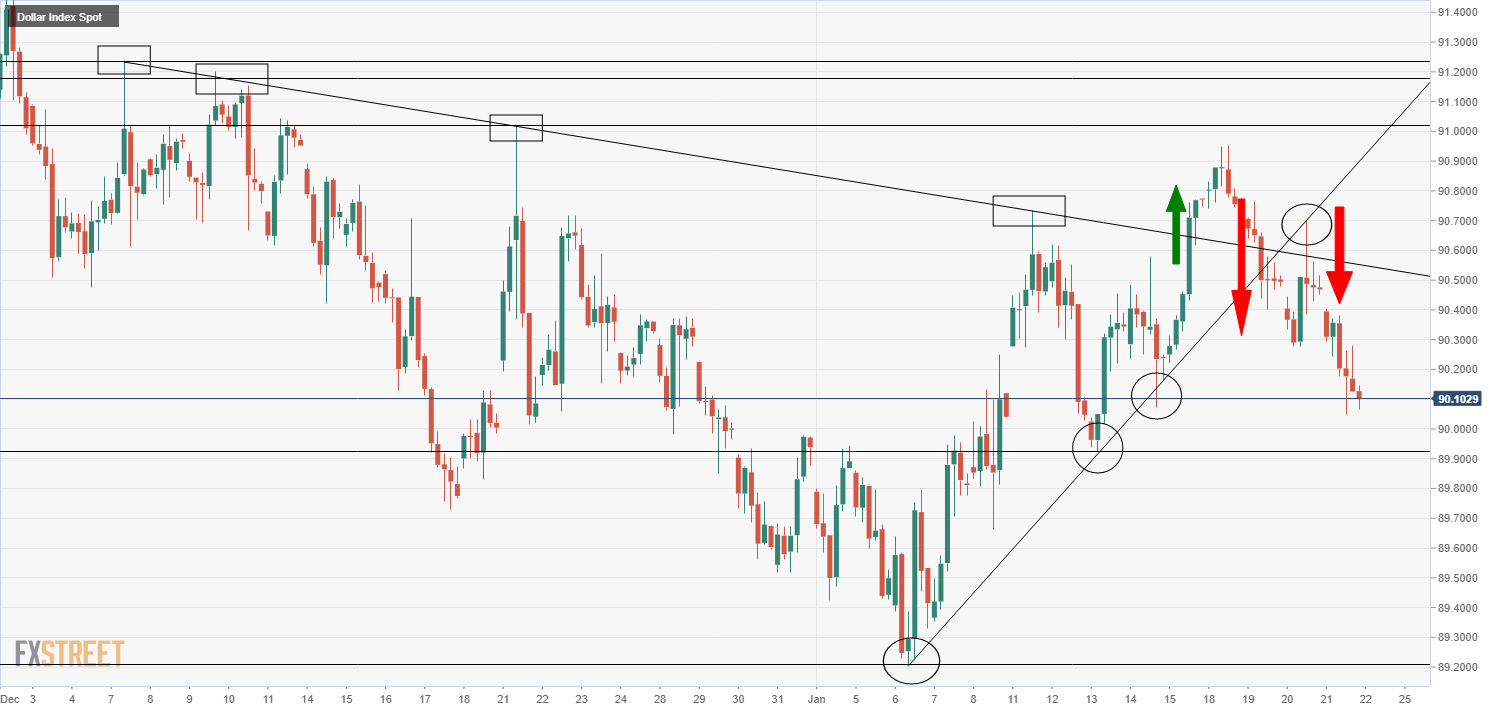

The Dollar Index (DXY) came under further selling pressure on Thursday, dropping about 0.4% or just under 40 points to fall to fresh lows of the week under 90.10. The trade-weighted basket of major USD exchange rates also dropped back below its 21-day moving average, which currently resides at 90.147.

DXY breaking trendlines

Some thought the trendline break of importance was the break above the downtrend linking the 7, 9 and 21 December and 11 January highs. The break of this trendline last Friday opened the door to a brief test attempt to move back to the 91.00 level, but this ultimately proved to be a fakeout. Within a day, the DXY was back below this downtrend and broke below another trendline that traders had been keeping an eye on; the uptrend linking the 6, 13 and 14 January lows. DXY even retested this uptrend on Thursday, practically to the tick. It proved to be the perfect classic break of a trend line, retest, then resume back in the breakout direction; the DXY has since dropped back towards the 90.00 level.

A break below this psychologically important level, as well as last week’s 89.92 low, will open the door to a potential move back to annual and multi-year lows in the 89.20s. A break below that will open the door to further selling pressure and test of the 2018 low at 88.25. If DXY can break this level, that would put it at its lows since December 2014.

DXY four hour chart