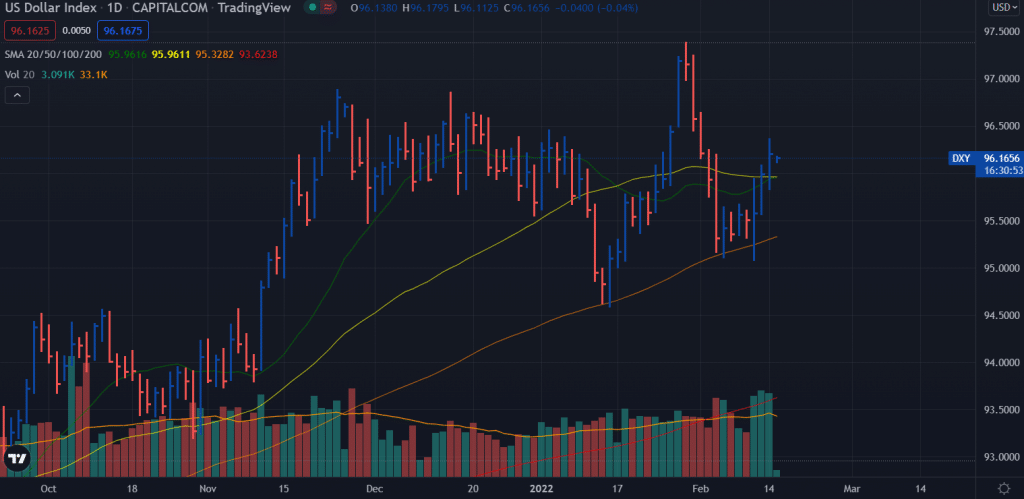

- Despite a 3-day uptrend, DXY is pulling back from a 2-week high.

- After a positive start to the week, the US 10-year Treasury yield declined.

- Fears of an imminent Russian invasion of Ukraine deteriorated the market sentiment. As a result, the much-debated date is February 16.

- PPI and the New York Manufacturing Survey data will grace the calendar, but the key is Fedspeak, which is the risk catalyst.

During Tuesday’s Asian session, the US Dollar Index (DXY) price fell from a two-week high of 96.20. Meanwhile, the dollar index fell 0.09% on the day, posting its first daily loss in four days, tracking the bearish US Treasury yields.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Over the past few days, the disappointing signals on the Russian-Ukrainian situation have combined with the growing possibility of a 0.50% rate hike in March to keep DXY bulls on their toes. The recent decline in the US Dollar Index appears to be due to dovishness in the market and a weak calendar.

In contrast, headlines about Russian Foreign Minister Sergei Lavrov initially encouraged markets to remain optimistic that there were no imminent fears of war between Russia and Ukraine as he supported US proposals. Yet, statements such as “The response of the EU and NATO was unsatisfactory” indicated high-risk aversion.

The market was also impacted by comments made by St. Louis Fed President James Bullard, who reaffirmed his call for a 100-basis point (bp) rate hike by July 1, citing the last four inflation reports as proof of rising inflationary pressures.

Also weighing on sentiment is the CME FedWatch, which projects around a 61% chance of a 50-75 basis point (bp) rate hike during the March session.

With sentiment improving, US Treasury yields decline, down 2.4 basis points (bp) to 1.972%. Meanwhile, S&P 500 futures are posting modest losses at the latest. Bond coupons rallied on Monday after falling from a 2.5-year high on Friday despite slightly positive results earlier in the week.

As geopolitical concerns add to Fed hawkish fears, the DXY pullback appears to be short-lived.

Furthermore, January’s US Producer Price Index (PPI) is expected to hit 9.1% year over year, down from 9.7% previously, as well as the Empire State Manufacturing Index for February, according to a market consensus forecast of 12 points compared to -0.7% previously.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

DXY price technical analysis:

The US dollar index (DXY) price remains above the key moving averages on the 4-hour chart. The bullish crossover between 20-period and 50-period SMAs may support the bulls. However, the price may retrace before continuing the further upside. The support levels are 96.00 ahead of 95.75 and then 95.50. On the upside, resistance levels include 96.40 ahead of 96.80 and then 97.30.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money