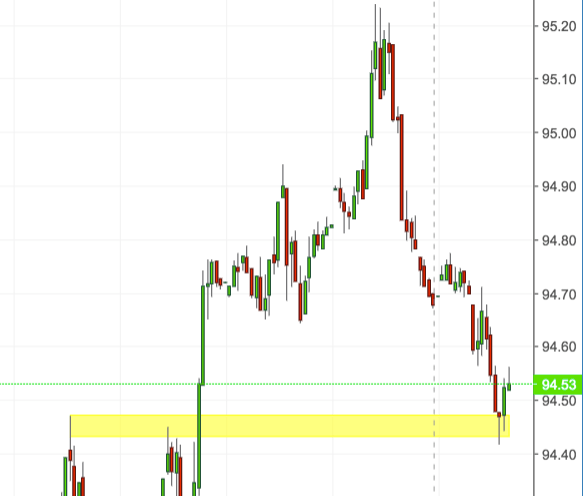

- The greenback drops to fresh 4-day lows, although decent contention emerged in the 94.50/45 band, coincident with the hourly high recorded on July 10, the 200-hour SMA and the 10-day SMA.

- The prospect for the buck stays constructive for the time being as the area around 94.50 still underpins. However, it needs to clear Friday’s peak at 95.24 in order to reassert the upside pressure and open the door for a potential test of the mid-95.00s.

- Once cleared, the psychological handle at 96.00 the figure should be back on investors’ radars ahead of 96.51, monthly high July 2017.

DXY Hourly chart

Daily high: 94.77

Daily low: 94.41

Support Levels

S1: 94.43 10-day SMA/200-hour SMA

S2: 94.04 55-day SMA, Fibo retracement

S3: 93.71 low July 9

Resistance Levels

R1: 95.24 high July 13

R2: 95.25 200-week SMA

R3: 95.53 2018 high June 28