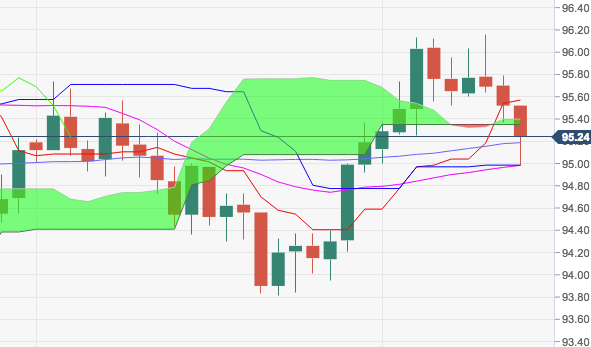

- DXY keeps correcting lower after failing to advance further north of recent tops beyond the 96.00 milestone earlier in the week.

- The 21-day SMA at 94.95 held the selling impetus so far. This area of support appears reinforced by the 100-day SMA at 94.86

- The continuation of the downside could see the 38.2% Fibo retracement of the 2017-2018 drop at 94.20 tested.

- In the meantime, the index should keep the constructive bias unchanged above 93.71, July’s low.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.28

Daily change: -24 pips

Daily change: -0.251%

Daily Open: 95.52

Trends:

Daily SMA20: 94.97

Daily SMA50: 95.24

Daily SMA100: 94.85

Daily SMA200: 92.74

Levels:

Daily High: 95.79

Daily Low: 95.37

Weekly High: 96.13

Weekly Low: 95

Monthly High: 96.13

Monthly Low: 93.81

Daily Fibonacci 38.2%: 95.53

Daily Fibonacci 61.8%: 95.63

Daily Pivot Point S1: 95.33

Daily Pivot Point S2: 95.14

Daily Pivot Point S3: 94.91

Daily Pivot Point R1: 95.75

Daily Pivot Point R2: 95.98

Daily Pivot Point R3: 96.17