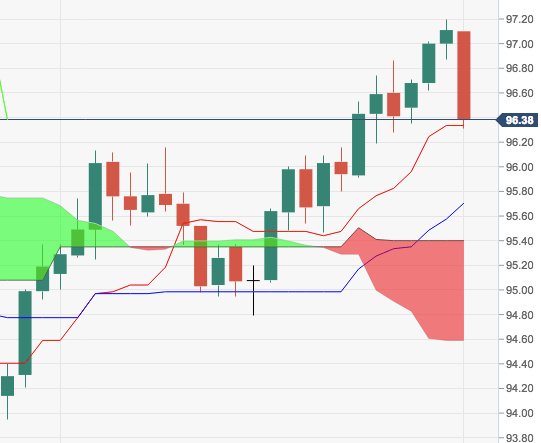

- Today’s sharp sell off in the greenback is prompting DXY to recede further from recent YTD tops near 97.20 and instead to focus on the 96.00 neighbourhood.

- In fact, the continuation of the down move is expected to face contention at 96.04, the 50% Fibo retracement of the 2017-2018 drop. A break of this level should put the 21-day SMA at 95.92 back on the horizon.

- A resumption of the uptrend faces the immediate hurdle at recent peaks at 97.19, while further upside should meet the next resistance at 97.87, where converge the 61.8% Fibo retracement of the 2017-2018 drop and June 2017 peak.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 96.37

Daily change: -74 pips

Daily change: -0.762%

Daily Open: 97.11

Trends:

Daily SMA20: 95.92

Daily SMA50: 95.3

Daily SMA100: 95.15

Daily SMA200: 93.1

Levels:

Daily High: 97.2

Daily Low: 96.87

Weekly High: 96.86

Weekly Low: 95.47

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 97.07

Daily Fibonacci 61.8%: 97

Daily Pivot Point S1: 96.92

Daily Pivot Point S2: 96.73

Daily Pivot Point S3: 96.59

Daily Pivot Point R1: 97.25

Daily Pivot Point R2: 97.39

Daily Pivot Point R3: 97.58