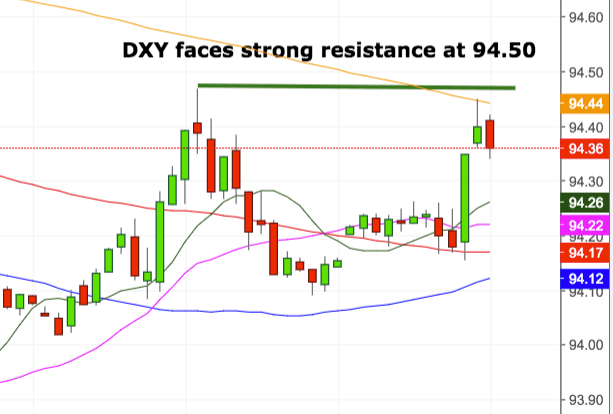

- DXY extends the rebound well beyond the 94.00 milestone after finding dip-buyers in the 93.75/70 band, or Monday low, area coincident with the top of the cloud.

- The index quickly left behind the Fibo retracement of the April-June climb just above 9400 the figure and tested the boundaries of the relevant hourly high at 94.50 during Tuesday’s session.

- Further gains should emerge if the buck manages to clear the 10-day SMA and the 21-day SMA, at 94.41 and 94.64, respectively. For the up move to gain sustainability, the greenback should also clear the critical 95.00 handle.

- Daily RSI (14) stays around 51 at the time of writing, allowing for further upside.

DXY hourly chart

Daily high: 94.46

Daily low: 94.11

Support Levels

S1: 94.04 Fibo retracement

S2: 93.92 top of the cloud

S3: 93.84 55-day SMA

Resistance Levels

R1: 94.64 21-day SMA

R2: 95.03 high May 29

R3: 95.53 2018 high June 28