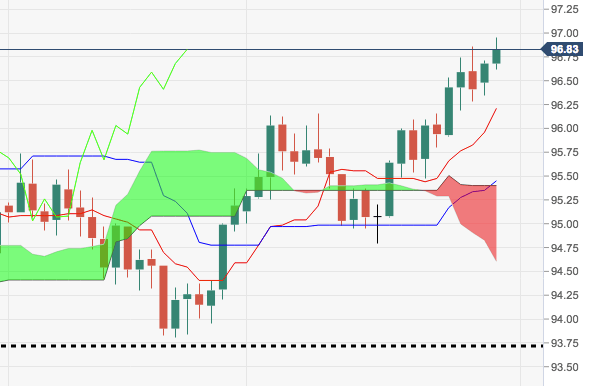

- The index is extending the positive mood on Tuesday and is approaching the critical resistance at YTD peaks in the 97.00 neighbourhood.

- A break above 97.00 is needed to extend the move further north and target the 97.87 level, where coincide a Fibo retracement of the 2017-2018 drop and June 2017 peak.

- The up trend in the buck is reinforced by the index trading above the daily cloud for the time being.

- The broader picture keeps telling that DXY stays bid as long as it trades above July’s low at 93.71.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 96.84

Daily change: 16 pips

Daily change: 0.165%

Daily Open: 96.68

Trends:

Daily SMA20: 95.79

Daily SMA50: 95.23

Daily SMA100: 95.09

Daily SMA200: 93.03

Levels:

Daily High: 96.71

Daily Low: 96.35

Weekly High: 96.86

Weekly Low: 95.47

Monthly High: 95.74

Monthly Low: 93.81

Daily Fibonacci 38.2%: 96.57

Daily Fibonacci 61.8%: 96.49

Daily Pivot Point S1: 96.45

Daily Pivot Point S2: 96.22

Daily Pivot Point S3: 96.09

Daily Pivot Point R1: 96.81

Daily Pivot Point R2: 96.94

Daily Pivot Point R3: 97.17