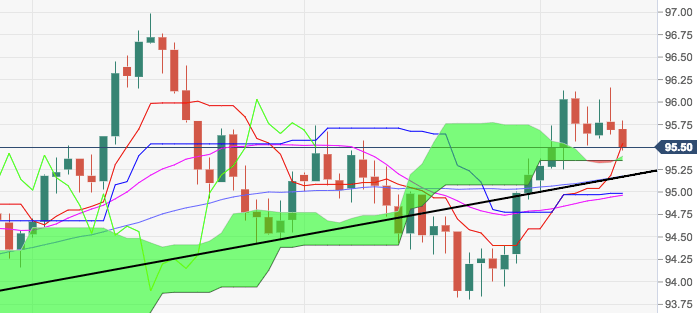

- The greenback is now accelerating the downside and trades in fresh weekly lows in the mid-95.00s.

- The continuation of the down move could see the short-term support line at 95.17 tested.

- In the meantime, the constructive view remains in place as long as this support line underpins, with the immediate target at recent peaks beyond 96.00 the figure.

- Sustaining further the outlook, DXY continues to trade above the daily cloud.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.46

Daily change: -23 pips

Daily change: -0.240%

Daily Open: 95.69

Trends:

Daily SMA20: 94.94

Daily SMA50: 95.22

Daily SMA100: 94.83

Daily SMA200: 92.72

Levels:

Daily High: 96.16

Daily Low: 95.64

Weekly High: 96.13

Weekly Low: 95

Monthly High: 96.13

Monthly Low: 93.81

Daily Fibonacci 38.2%: 95.84

Daily Fibonacci 61.8%: 95.96

Daily Pivot Point S1: 95.5

Daily Pivot Point S2: 95.31

Daily Pivot Point S3: 94.98

Daily Pivot Point R1: 96.02

Daily Pivot Point R2: 96.35

Daily Pivot Point R3: 96.54