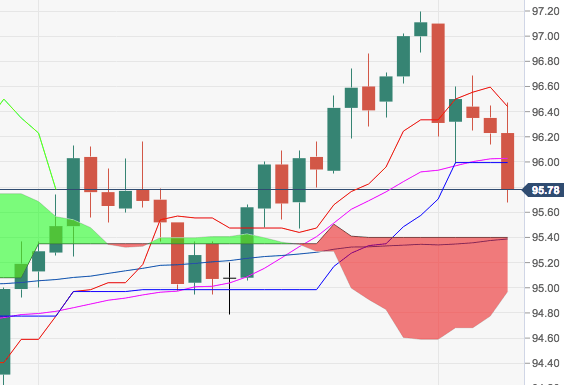

- The greenback accelerated the weekly leg lower following the results from the US mid-term elections and is now testing multi-day lows in the 95.85/80 band.

- DXY broke below the critical support at 96.00 the figure and in doing so has opened the door for a potential drop and test of the 95.40 region, where coincide the 55-day SMA and the top of the daily cloud.

- However, the constructive bias should remain unchanged while above the 93.71 level, July’s low.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.8

Daily change: -43 pips

Daily change: -0.447%

Daily Open: 96.23

Trends:

Daily SMA20: 96.04

Daily SMA50: 95.41

Daily SMA100: 95.21

Daily SMA200: 93.24

Levels:

Daily High: 96.45

Daily Low: 96.14

Weekly High: 97.2

Weekly Low: 95.99

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 96.26

Daily Fibonacci 61.8%: 96.33

Daily Pivot Point S1: 96.1

Daily Pivot Point S2: 95.96

Daily Pivot Point S3: 95.79

Daily Pivot Point R1: 96.41

Daily Pivot Point R2: 96.58

Daily Pivot Point R3: 96.72