- Following a drop to fresh multi-day lows in the 94.30 region, the buck met dip-buyers and is now flirting with the initial upside target located at 94.60, where sits the 21-day SMA.

- DXY needs to overcome last Friday’s peak at 95.24 in order to resume the up move and set sails for a potential test of 2018 peaks in the mid-95.00s and then the 96.00 mark.

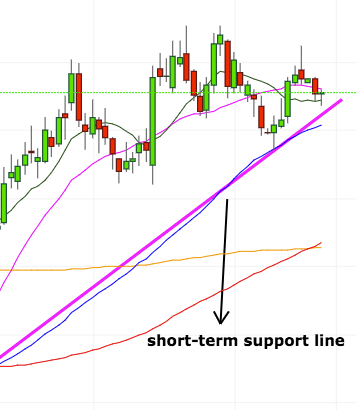

- In the meantime, the buck remains ‘just’ underpinned by the 3-month support line off 89.23 (mid-April), today in the 94.30/20 band.

- Strong support should emerge around the 94.00 neighbouhood, where converge the 55-day SMA and a retracement of the April-June rally.

DXY daily chart

Daily high: 94.65

Daily low: 94.29

Support Levels

S1: 94.36

S2: 94.20

S3: 94.00

Resistance Levels

R1: 94.72

R2: 94.92

R3: 95.08